Tuesday 16 July 2019

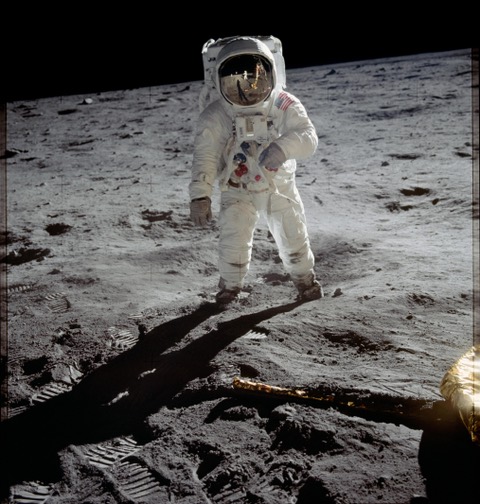

Even for those with no interest in space exploration it must be hard to avoid the fact that this month is the 50th anniversary of Apollo 11 making the first landing on the moon. As regular readers know I have a strong interest in space and particularly the Apollo programme and so as in previous years I have to mark the anniversary in some small way.

Whichever way you look at it Apollo 11 – and the entire Apollo programme – was an incredible achievement, the result of eight years of dedicated, focused effort from up to 400,000 people, marshalled and directed by a government agency co-ordinating hundreds of contractors and sub-contractors. What can we learn from Apollo half a century on?

First of all there is the importance of a clear objective. President John F. Kennedy set out the objective in his speech to Congress on 25th May 1961, at which point the US had the grand total of 15 minutes of crewed sub-orbital space flight experience: “First, I believe that this nation should commit itself to achieving the goal, before this decade is out, of landing a man on the moon and returning him safely to the Earth.” This crystal clear objective came to be shortened as “man, moon, decade” and served as the touchstone for the programme and of course was achieved on 24th July 1969 when Apollo 11 splashed down in the Pacific and Neil Armstrong, Buzz Aldrin and Michael Collins were safely recovered onto the aircraft carrier USS Hornet.

Another lesson is the value of leadership taking bold steps. Throughout the Apollo programme political and programme leaders, exhibited boldness of a level which seems near impossible today. Douglas Brinkley in “American Moonshot” describes John F. Kennedy’s philosophy of courage as being “life is short, bold steps forward are immortal, so act.” The whole idea of landing on the moon inside a decade was so bold, especially so early in the development of space technology, that even many NASA managers were shocked by the commitment. The technology did not exist, even the method of getting to the moon (Lunar Orbital Rendezvous) was not decided until July 1962 – it was another three and half years before the ability to actually rendezvous in space at all was demonstrated by Gemini VI and VII. NASA’s decision to send Apollo 8 into lunar orbit in December 1968, driven partly by intelligence that the Soviet Union was planning a manned lunar flyby and by delays in the Lunar Module was incredibly bold. Apollo 8 was only the second manned Apollo flight and only the third launch of the monstrous Saturn V. The idea of sending Apollo 8 to the moon started in August 1968 with a final decision in November, after Apollo 7 had met its objectives in Earth orbit. In the four months before the mission the flight plan had to be developed, software written and the crew and Mission Control trained for a new mission.

Another lesson from Apollo is that exploration is hardwired into human DNA. Although the timing of the Apollo programme was driven by Cold War rivalries the idea of going to the moon and beyond is a centuries old dream. The advances in technology, many of which we are benefitting from today, and the scientific harvest were immensely valuable, but we explore because it is in our nature. Otherwise we would still be living in trees, or the ocean. Although we clearly need to address problems on earth we cannot suppress the desire to explore the solar system and beyond.

The power of purpose in organisations is now beginning to be recognised. Apollo – and space exploration – gave many people a higher purpose, one for which they were prepared to make great personal sacrifices. Admittedly there was no idea of life-work balance back then and many individuals and families paid a very high price but it was a choice made for a higher purpose. Some people of course, including astronauts and workers gave their lives.

In summary we can learn a lot from Apollo. We certainly need clear objectives to solve our environmental and social problems and we need bold leadership, something that appears lacking today – at least amongst politicians. Of course we also need the long-term financial commitments that underpinned Apollo – as JFK said in a less well known part of his speech to Congress, “I am asking the Congress and the country to accept a firm commitment to a new course of action, a course which will last many years and carry very heavy costs”. Yes, the programme was expensive, although tiny compared to defence spending, but its yield in terms of new technology, science, STEM education and the inspiration of generations of scientists and engineers was huge and continues to this day.

Having studied every detail of the Apollo programme I could find for more than fifty years I still find it incredible and the more I learn the more amazing it is. Even if you are not that interested in space I highly recommend reading at least one of the books or seeing at least one of the films commemorating the Apollo 11 anniversary. I recommend; “American Moonshot” by Douglas Brinkley, “Apollo 11 The Inside Story” by David Whitehouse and “Chasing the Moon” by Robert Stone and Alan Andres, which is also a documentary shown on PBS and the BBC. If you only do one thing see “Apollo 11” which tells the whole story of Apollo 11 in archive footage and includes some previous unseen 70mm film that was locked away for years and forgotten. Watch it and be amazed.

Wednesday 19 June 2019

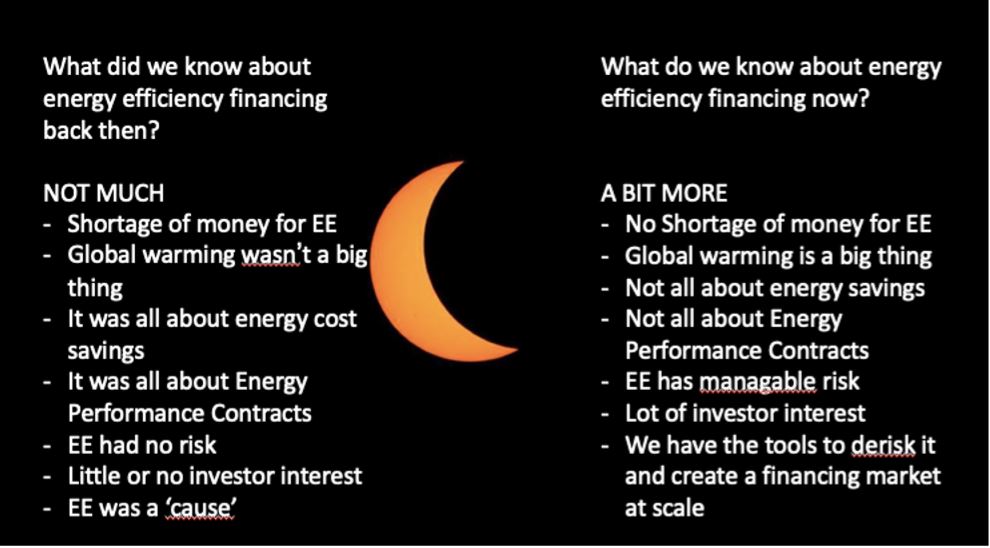

One of the most memorable phrases I first heard at the ACEEE Finance Forum in 2012 was that ‘the problem with efficiency financing is that the ratio of conferences to deals is too high’. That remains true although there are good signs that the ratio is improving, the number of conferences seems the same (or maybe higher) but the number and value of deals is definitely increasing in lots of places around the world. On my recent trip to Bucharest for the 2nd Round Table on Energy Efficiency Financing held under the auspices of the Sustainable Energy Investment Forum I saw more evidence of this change. The meeting was encouraging because a) several banks were in the room leading the conversation (& deals) and b) there are a now a number of successes to point to.

The first of these was a UNDP Global Environment Facility project which I had a small part in designing when I first went to Bucharest in the 1990s and was implemented from 2003 through to 2006. This project was executed extremely well with only $2m of UNDP money which supported project development assistance and capacity building, and yet catalysed nearly $70m of private investment into 34 energy efficiency projects, compared to a target of $12.5m and 20 projects. Although I had not developed my jigsaw of energy efficiency financing back then on reflection the project had the four pieces of the jigsaw, finance (development and project), building pipelines, standardisation, and capacity building within the demand side, the supply side and the finance industry. The implementing consultants carried out activities in all four areas. Although it is now a long time ago, the project merits study for anyone designing programmes designed to catalyse private investment using a small amount of public money.

Since the UNDP GEF project there has been a series of EBRD Green Economy Financing Facility (GEFF) facilities that ran between 2008 and 2018; the Energy Efficiency Finance Facility (EEFF) – for private sector industrial companies, the Municipal Fund for Energy Efficiency (MFFEE) – for municipalities, and the Romania Sustainable Energy Finance Facility (RoSEFF) which financed projects in SMEs. These facilities provided technical assistance to help develop and close projects and used a mixture of grants from the EU (between 10% and 20%) and loans to finance projects. The EEFF made 129 investments totalling €111m, the MFFEE deployed €10m into three public lighting schemes, and the RoSEFF made 341 investments totalling €69m. The current GEFF in Romania was launched in 2017 and is a €100m financing framework for the household sector, the first time this sector has been specifically addressed. Concessional financing is provided by the TaiwanICDF through EBRD to local financial institutions Banca Transilvania and UniCredit Bank and to date $64m has been deployed. The facility consultant, Tractebel, trains local financial institution branches how to recognise and act upon energy efficiency lending opportunities which builds capacity and ensures extensive outreach throughout the branch network.

The other exciting project is the Romania Green Building Council’s ‘Smarter Finance for Families’. This project developed a low-cost, local green home certification system in which homes have to achieve an energy performance more than 30% better than an A rated home and have other green features including use of non-toxic materials and reduced construction waste. Furthermore the scheme links this to green mortgages from major banks which offer lower interest rates for homes certified to the standard. The programme now accounts for about 10% of total new home building in the country. This would have been unimaginable back when I worked in Romania in the mid-1990s and is a great achievement by the Romania GBC who are now replicating it in 11 countries with the support of a Horizon 2020 funded project. Like the other successful projects it has the four elements of the energy efficiency financing jigsaw.

The last time I had been in Bucharest was for the total solar eclipse on 11 August 1999 and after twenty years away it was great to see some old friends and colleagues as well as the big changes in Bucharest, which is a lot more pleasant to be in than it was back then. There is a lot of building rehabilitation underway, rehabilitation that has to improve earthquake resistance as well as thermal performance. Much work needs to be done to increase the flow of capital into increasing the performance of the building stock in all aspects but that applies everywhere. The country is moving in the right direction and the continuing dialogue between banks and other stakeholders catalysed by events such as the Roundtable, coupled with the available tools such as the Romania Green Building Council standards, the Investor Confidence Project, the EEFIG Underwriting Toolkit and the Derisking Energy Efficiency Platform (DEEP), will help accelerate the trend.

Although I greatly enjoy speaking at conferences our real work is working to improve the ratio of projects to conferences – that is getting more investment into energy efficiency. If you share this mission and want to discuss how EnergyPro can help you let me know.

Tuesday 28 May 2019

Infrastructure and sustainability

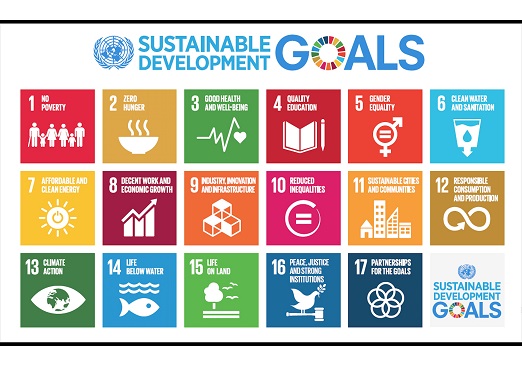

Ultimately the multiple environmental and social challenges – not only climate change but dangerous air pollution, ocean acidification, providing modern energy to those without it, and feeding a growing population just to name a few – which are addressed by the Sustainable Development Goals – all come down to our choice of infrastructure and its design. In this context infrastructure is not exactly the same meaning as the traditional definition of infrastructure used by investors but there is close overlap.

Our existing infrastructure in the domains of energy, the built environment, transport, and agriculture, was designed and built in a different age with different levels of technical know-how, a very low knowledge of and consideration of human impacts on the environment, and a very different set of social and economic parameters. Existing infrastructure, for example large centralised fossil fuel burning power plants, our electricity distribution system and our built environment, were designed the way they were designed with the level of available technology, in the economic circumstances and the regulatory and institutional set-up of the time.

Much (most) of it is no longer appropriate for today’s world and the need, and desire, is to address the Sustainable Development Goals. We now have much expanded technical capabilities, expanded knowledge and consideration of environmental and social impacts of our choices around infrastructure, and different economic and social drivers. Information technology and the availability of data are breaking down barriers between infrastructure silos – for example everyday buildings can be power stations and cars can become electricity storage devices.

Given the long life of infrastructure investments we need to be making different choices that result in smarter, more resilient, greener, higher performing infrastructure. We also need to ensure that current infrastructure projects do not lock in poor environmental performance, doing so risks making environmental problems worse and assets becoming stranded. The combination of technology and infrastructure – “Infratech” – gives us enhanced ability to make different choices.

Infratech

Infratech has been described as “the deployment or integration of digital technologies with physical infrastructure to deliver efficient, connected, resilient and agile assets. This combination of physical and digital infrastructure designs and produces assets that respond intelligently, or inform and direct their own maintenance, use and delivery. These assets may also be automated and responsive to real-time or historical data. This produces benefits not only for the developer/operator, but also to the end-user in terms of efficiency, productivity and a better overall experience.” Investors are now more interested in the characteristics of infrastructure investments rather than the old definitions. The characteristics of high performance infrastructure are that it is effective in its main mission, smart, green, resilient and produces other social benefits.

Infratech covers all infrastructure domains including:

- Energy generation and distribution

- Built environment

- Transport

- Water and waste

- Food production

- Resource extraction, processing and use

- Communications

- Health and well-being

- Life safety systems.

and can include many types of technology including amongst others:

- digital monitoring and control systems

- e-commerce systems

- smart materials.

Combining technology and infrastructure can produce higher performance assets that are more effective, more efficient, smarter, greener and more resilient. Infratech can increasingly integrate these domains through the availability of data and control, changing economics and new business models.

To achieve the ambitious but essential SDGs we need to use Infratech to improve the quality of infrastructure investments, so that they contribute directly to the SDGs, and increase the rate of investment in smarter, greener, more resilient infrastructure.

We like working with companies doing just that and welcome conversations about how to maximize the growth of Infratech across all domains, not just energy, through informing, innovating, incubating or investing.

Wednesday 1 May 2019

‘Every investment is an impact investment’

Amy Clarke, Tribe Impact Capital

I have been thinking a lot about impact investing since speaking at the King’s Impact Investing Society conference at the end of January. There still seems to be a lot of debate about definitions but it seems clear that impact investing is any investment which is aimed at achieving a positive impact on some societal problem as well as a financial return, personally I think of it as investing to have a positive impact on sustainability. Then the question of how to benchmark and measure that impact arises. The Sustainable Development Goals (SDGs) are a good roadmap to all the areas where we need to improve sustainability – across environmental, social and economic spheres – and can form the basis of measurement. Impact investing aims to have a positive impact on key sustainability problems as well as make a return, it is not philanthropy. At the King’s conference Amy Clarke, the founder of Tribe said, “every investment is an impact investment” and that is correct – every investment has multiple impacts in the areas covered by the SDGs, some good, some bad, some intentional and some unintended. Impact investing is about focusing on making a positive impact as well as a financial return.

The question, that for so long has not been asked, and which impact investors ask, is what is the impact of this investment on the non-financial factors such as the environment, gender inequality, access to basic services or whatever areas the investment affects. Taking a systems view, we need to ask what is the totality of all the impacts of the investment? An impact investment should be positive in its impact on at least some of these factors. Important questions include; what is the base line for comparison, what are the targets and how do we measure progress? The SDGs are a set of global targets covering all aspects, economic, environmental and social and provide an overall context. Various initiatives to define and measure impacts now exist and are beginning to be applied more often. The Impact Management Project, which grew out of a project by Bridges Fund Management is one emerging global impact measurement tool.

Of course financial investors are not the only decision makers who have impact. Managers of organisations make decisions every day, small and large that have multi-dimensional impacts – whether they be decisions on which mode of travel to take or decisions to build a new factory or develop a new product. A systems based approach to investment appraisal should cover the non-financial impacts, both good and bad. To what extent and how do organisations that have environmental goals factor this into every decision? Appraisal of capital investment and the way it is taught and practiced is almost entirely focused on the financial aspect and yet we know that other non-financial factors can be more strategic and therefore important.

Consumers make purchase decisions every-day that have impacts – often impacts in distant and remote parts of the world in some part of the long supply chains, impacts that can be negative in various aspects when viewed against the lens of the SDGs. Systems that bring greater transparency of the impacts to consumers have emerged but we need a lot more of them such that consumers can factor them into their decisions. How can we measure and communicate the wider impact of relatively small purchase decisions to consumers?

Impact investing is growing in volume and this is a really positive trend but we also need to think about, and talk about impact managing and impact consuming. Every investment decision, every management decision and every purchase decision has multiple impacts.

EnergyPro works to identify, develop and implement impact investment opportunities, particularly in support of the energy transition but also in other dimensions of sustainability. We also work with organisations to help them make more impactful decisions.

If we can help you in these areas let us know.

Steve Fawkes speaking at King’s Impact Investing Society Conference 2019

Wednesday 17 April 2019

Although there is still a lot to do to deliver the transition to a cleaner, low carbon, more flexible energy system, it does sometimes feel that the seismic plates in energy have shifted and that the outcome is inevitable. That should not be taken to mean we can relax – not only is there a lot to do to deliver existing and new technologies, business models and regulation – we still have to combat the resistance of the old guard who as in any paradigm shift spread confusion and fight to hang onto their positions. However the other dimensions of improving sustainability cannot be ignored. Earlier in the year we saw the report on how “rapidly declining insect populations could threaten the collapse of nature” which reminded me of the book “Wilding” which I read recently.

‘Wilding’, which I highly recommend, tells the story of Knepp Castle Estate in West Sussex which since 2001 has switched from traditional intensive (and unprofitable) agriculture to rewilding which has resulted in an incredible increase in biodiversity. The approach is to establish a functioning ecosystem and let nature get on with it – rather than target specific goals or species. Knepp has seen great increases in bio-diversity and become a breeding ground for several species that were absent or in severe decline including, purple emperor butterflies, turtle doves, nightingales and 13 out of the 17 UK resident species of bats.

Rewilding Britain define rewilding as follows:

Rewilding is the large-scale restoration of ecosystems where nature can take care of itself. It seeks to reinstate natural processes and, where appropriate, missing species – allowing them to shape the landscape and the habitats within.

Rewilding encourages a balance between people and the rest of nature where each can thrive. It provides opportunities for communities to diversify and create nature-based economies; for living systems to provide the ecological functions on which we all depend; and for people to re-connect with wild nature.

https://www.rewildingbritain.org.uk/rewilding/

Attaining greater sustainability requires ensuring we have food supplies as well as protecting the environment, objectives that can clearly be in opposition to each other. The food production system is essential infrastructure, although it is not usually characterised as such. As in other areas of infrastructure we are seeing a shift towards digitisation, we are also seeing a shift towards production of food in controlled environments. Like producing buildings, producing food in a controlled environment rather than out on site makes a lot of sense and the ability to control environments, possibly in an urban location, can raise productivity as well as reduce resource input for production and transportation.

The idea of the environment created by large-scale farming as being somehow natural, an idea we all grew up with, is clearly wrong – the agricultural environment is as man-made as the inner city and maybe it is largely incompatible with truly protecting nature. The combination of food production in a controlled environment and rewilding provides a clear direction of travel. We need to greatly ramp up food production in controlled environments, out of the field and into the converted warehouse, and then rewild former agricultural land.

Our vision should be healthy food for all produced in controlled and efficient environments enabling large areas of the land and seas to be rewilded.

Dr Steven Fawkes

Welcome to my blog on energy efficiency and energy efficiency financing. The first question people ask is why my blog is called 'only eleven percent' - the answer is here. I look forward to engaging with you!

Email notifications

Receive an email every time something new is posted on the blog

Tag cloud

Black & Veatch Building technologies Caludie Haignere China Climate co-benefits David Cameron E.On EDF EDF Pulse awards Emissions Energy Energy Bill Energy Efficiency Energy Efficiency Mission energy security Environment Europe FERC Finance Fusion Government Henri Proglio innovation Innovation Gateway investment in energy Investor Confidence Project Investors Jevons paradox M&V Management net zero new technology NorthWestern Energy Stakeholders Nuclear Prime Minister RBS renewables Research survey Technology uk energy policy US USA Wind farmsMy latest entries