Tuesday 20 November 2018

During my visit to Delhi to be a judge for the INSPIRE 2018 event I was privileged to be asked to speak to EESL managers on international developments in energy efficiency. I say privileged because talking to EESL about energy efficiency is like taking coals to Newcastle (as we used to say when there was a UK coal industry), or selling sand to the Middle East or snow to the Eskimos. EESL’s programmes such as UJALA, smart meters and EVs are massive in their scale, inspirational in their ambition and vitally important for Indian and global development. The rest of the world has a lot to learn from them.

Here are some brief thoughts that emerged from my presentation.

Context

To achieve our energy and climate goals we need to greatly ramp up investment into energy efficiency. The recently published 2018 Energy Efficiency Market report highlighted that we need to double the current level of investment into energy efficiency (c.$260 bn) by 2025 and then double it again by 2040. Although this is ambitious when I look around the world I see a number of emerging trends that make me optimistic that energy efficiency can start to fulfil its huge economic and environmental potential. For forty years we have known the scale of that potential but also known that the uptake of cost-effective potential remains low.

Energy efficiency technology innovation

Energy efficiency technologies are being deployed across all sectors; buildings, industry, appliances, energy production, transport and information technology and new technologies are appearing. We don’t actually need new technology to achieve our ambitions, just increasing the rate of application of existing, well proven, cost-effective technology, however innovation is always happening and appears to be accelerating. The application of IT and big data in particular is an area that is rapidly evolving and has huge potential. The application of AI, as demonstrated by the use of Deep Mind in Google data centres that saved 40% on already efficient centres highlights the potential. Another end of the spectrum is the redesign of basic equipment such as process heaters such as those from ProHeat. Like much of our infrastructure the basic design of process heaters has not changed for decades (or even a century or more) and the technology was designed when energy usage or costs were not considered. Re-design of basic equipment like process heaters, using thermos-syphon heaters, can save 45% of energy use in very high energy using equipment.

Changing electricity markets

Electricity markets everywhere are changing rapidly with the deployment of renewables, decentralisation and the emergence of prosumers, as well as electrification of transport and heating. The emergence of the ‘duck curve’ is creating problems for network operators grappling with the need for greater quantities of, and faster responding flexibility. Distributed energy resources including localised solar, demand response, battery storage, and vehicle to grid solutions will all play large parts in future electricity markets. If energy efficiency is to exploit this change we need to rethink it and make it measurable, reliable and able to be contracted for. We also need to recognise that like other distributed energy resources energy efficiency will have different values at different times and in different locations – in highly constrained network areas and at constrained times energy efficiency will have more value. Technologies like OpenEE enable the measurement and valuation of efficiency as a distributed energy resource.

Changing customer requirements

Another change, or perhaps it is not a change at all, is that most consumers don’t really care about energy efficiency at all. They care about strategic issues like resilience, productivity, health and well being etc. We are only just recognising the importance and value of non-energy benefits which usually are more strategic and more interesting than cost savings. Non-energy benefits will become increasingly important in preparing better business cases, something that the energy efficiency industry has traditionally been bad at. Simply justifying efficiency on its payback from energy savings is not enough, we should emphasise the strategic non-energy benefits and sell energy cost savings almost as a side effect.

Growing interest from financial institutions

Over the last five to ten years financial institutions have become interested in energy efficiency and this has to be a good thing. Having said that efficiency presents many problems to institutional capital including lack of standardisation, lack of scale and lack of capacity within financial institutions. These factors are now being addressed through projects like the Investor Confidence Project and the EEFIG Underwriting Toolkit.

Growing recognition that energy efficiency projects do have risks

It was always said that energy efficiency was very low, or even zero risk. There is no such thing as a zero risk project anywhere – if you can find one invest in it. We are finally recognising, and more importantly gathering data on, the real performance of projects which shows, not surprisingly, that some projects over-perform and some under-perform, but in a portfolio the performance is usually good. This recognition and data will enable new financing solutions and insurance products that utilise the portfolio effect and can make financing easier.

Increased activity in financing efficiency

We have many mechanisms for financing efficiency and they can be used for different situations and market places, but there is no silver bullet or need for new ‘innovative financing methods’ (often code for subsidy or grant in some form). What seems to be true, however, is that to get finance to flow at scale it is necessary to bring together four elements: finance – both risky development finance and low risk project finance; a way of building pipelines of projects; standardisation in project development, documentation and underwriting, and capacity building in the demand side, the supply side and the finance industry. This is what I call the jigsaw of energy efficiency financing. There are different ways of organising but all successful examples such as EESL, the Etihad Super ESCO and the Carbon & Energy Fund in the UK, bring these four elements together.

Conclusions

As all the trends described above continue to emerge and grow, the huge global energy efficiency resource in all sectors will become easier to exploit and investment levels will grow, resulting in energy use and cost reductions beyond the standard, official forecasts, as well as bringing the many valuable non-energy benefits.

Steve Fawkes, Managing Partner, EnergyPro, receiving thanks for being part of the INSPIRE 2018 judging panel from Shri R.K. Singh, Hon’ble Minister of Power, New & Renewable Energy, (I/C), Govt. of India.

Thursday 8 November 2018

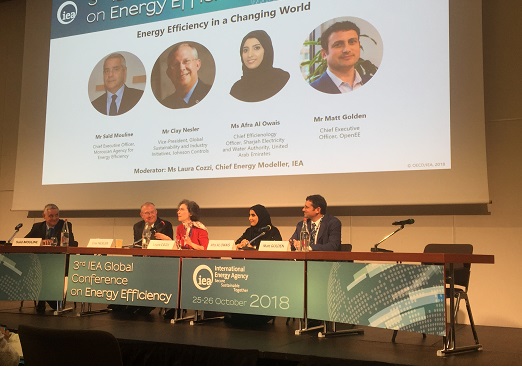

At the recent IEA Energy Efficiency Conference EnergyPro contributed to a side meeting The Role of Energy Efficiency in Europe’s Flexibility Agenda. The session was designed to discuss new business models and technologies that enable efficiency to contribute to flexibility. In particular we, along with Matt Golden, focused on OpenEE which enables utilities, network operators and programme managers to meter the effect of energy efficiency in time and location. This technology is now being applied in a growing number of US states to measure and value the impact of energy efficiency programmes and enable pay for performance programmes, where payment is directly related to energy savings rather than based on capital spent or deemed savings.

There is much talk about the barriers to fully utilising the massive potential for cost-effective energy efficiency but a fundamental problem is that there is no market for energy efficiency, only various diverse markets for stuff that we hope save energy. Functioning markets need standardised units, standardised contracts, known risks and liquidity – and energy efficiency traditionally has none of these. OpenEE provides the standardised units through its open source calculations – it is a weights and measures system for energy efficiency. Once you can measure and reward the effect of energy efficiency measures you can enable any technology and target programmes more effectively. Everyone know that the electricity market is changing rapidly, as diverse and distributed energy sources increase the need for flexibility will increase even further and OpenEE enables network operators to treat energy efficiency like any other distributed energy resource.

With the rapid changes in energy markets and technologies our traditional views of energy efficiency have to change, if they don’t we will still be lamenting the under-utilised cost-effective energy resource in another forty years as we have done for the last forty years. This means energy efficiency should be treated like other energy sources and be allowed to compete on a level playing field in a functioning market. This means energy efficiency will have different values in different places and different times. It means developers need to recognise and capture the various sources of value at different levels; host and distribution system. It means developers will need to use more standardised ways of developing and documenting projects. It means we will have to use standard contracts like PPAs to buy negawatt hours and PPAs are financable instruments, this will open up new ways of financing efficiency.

It is time to build a functioning market for energy efficiency.

The programme for the event can be found here.

Thursday 1 November 2018

Last week I attended the “Smart Finance for Smarter Lighthouse Cities” seminar which brought together cities, investors and others working on the Sharing Cities Lighthouse project. This project brings together six cities across Europe with the ambitious aim of triggering €500 million of investment into smart city solutions and engaging with 100 cities. The interactive day was very productive.

The first question asked was “what does smart finance for smart cities mean?”. My answer was that it is finance that comes with the other pieces of the jigsaw that are essential to ensure a continuous flow of financeable deals, i.e. assistance to develop pipelines of bankable projects (“project development assistance”), capacity building for customers, project developers and the finance community, and standardisation that enables aggregation. The experience in energy efficiency is that finance alone (i.e. project finance) is not enough, there is no point just having finance for projects – that is what I call “dumb finance”. There is a wall of money seeking bankable projects, particularly projects with green credentials. I think the smart cities domain is in the same place.

Bankable projects have to be developed and that requires both skills and resources, technical, financial and managerial. Such skills are always in short supply, technical skills of all sorts are particularly in short supply at the moment, even in basic energy systems and particularly in emerging areas like smart cities. Furthermore cities everywhere lack resources, smaller cities have enough problems managing existing infrastructure let alone developing new projects, a problem made much worse by a decade or so of austerity. Somehow we need to build development skills, capacity and resources. Investors and financial institutions looking to deploy capital into smart infrastructure really need to address this problem which ultimately, in the absence of grants will mean accessing some high risk equity type capital. Perhaps cities, financial institutions and governments can come together to share and build resources through projects like Sharing Cities. We look forward to working with the project.

Wednesday 3 October 2018

I was glad to see that Amory Lovins returned to the subject of the size of the energy efficiency resource in a recent paper in Environmental Research Letters[1]. Amory mentions the oil and gas resource and reserve analogy that I wrote about again in May. The energy efficiency resource, just like other resources, is really found in the minds of people and the scale of the energy efficiency resource, just like oil and gas, is defined by our ways of thinking about them. Amory says in one of his brilliant phrases; “energy efficiency resources are infinitely expandable assemblages of ideas that deplete nothing but stupidity – a very abundant if not expanding resource”. My PhD back in the early 1980s, “The Potential for Energy Conserving Capital Equipment in UK Industry”, examined the viability of Gerald Leach’s 1979 Low Energy Strategy for the UK[2] and came to the conclusion that such a future was possible (in industry) even though it involved an improvement in energy efficiency of c.30%. As I have written about before[3], we have practically achieved that future – a future that back then was regarded as impossible by the energy industry, the government and most analysts at the time.

My view is that the potential using proven technology, current economics and “standard thinking” about energy efficiency is always about 30%. Thinking about energy efficiency in a different way using the integrative design techniques long pushed by Amory and others, but still not widely adopted, increases the size of the economic potential to much higher levels, maybe 60-70%.

As is often the way several ideas or conversations come together at once. I am currently reading “Zeronauts”[4] by environmental business guru John Elkington. It highlights the power of the idea of aiming for zero – zero energy, zero emissions, and zero environmental impact and highlights leaders who have worked to turn this idea into reality. Totally zero may not be possible in a particular situation but it is a powerful organising idea that opens up what may be possible. If leaders and decision makers don’t set a target and simply accept for instance a building built to building regulations, the potential efficiency resource remains unidentified and unexploited. Setting a target of zero energy may not actually result in zero but it certainly expands the way the design team and others think.

At the AECB’s recent conference, which was held in a community centre built to Passive House standards, I visited some Passive Houses and the Passive House technology is another example of how the mind defines the resource. Passive House is a technology, a combination of thinking and physical technologies, that enables the construction of a house that uses much less energy than a house built to building regulations, as well as delivering better comfort. If all new housing was built to Passive House standards the energy saving compared to houses built to code would be immense but most developers don’t even consider it, either because they don’t know about it or they believe it will cost more, or they don’t trust it. It takes leadership, stepping out of the norm, to specify a Passive House design as well as persistence often in the face of opposition.

Many large new developments are now being built with district heating to meet planning regulations. It would be much more cost-effective to simply build the development to Passive House standards, thus eliminating the need for district heating with all of its central plant pipes, heat exchangers and control systems, all of which have on-going maintenance requirements. But again, unless leaders and decision makers consider the possibility, as well as the benefits, that potential energy efficiency resource will not be exploited, locking in unnecessary energy use and complexity for many years or even decades.

To make another connection, this week I participated in the first Advisory Council meeting of the Horizon 2020 funded project, M-Benefits[5]. This important project is developing tools to help decision makers incorporate multiple non-energy benefits into decision making about energy efficiency projects. As I have said before, these non-energy benefits such as health, well-being, productivity, better learning outcomes etc., are far more strategic and therefore far more interesting to decision makers than simple energy cost savings. We need to focus selling efforts for low energy solutions on those benefits and regard energy (& consequent energy cost savings) almost as a bonus. Doing so will lead to better business cases, higher rates of approval for projects and higher investment into energy efficient solutions.

So for any situation, industry, commerce, domestic, or transport, we can continue to think about the energy efficiency resource in the old way – and we will achieve significant economic and environmental gains, or we can change the way we think about it, aim for zero, insist on integrative design and value non-energy benefits and we will achieve far more, far more than the mainstream views on what is possible.

[1] http://iopscience.iop.org/article/10.1088/1748-9326/aad965

[2] https://www.amazon.co.uk/Low-Energy-Strategy-United-Kingdom/dp/0905927206

[3] https://onlyelevenpercent.com/surprise-you-are-living-in-a-low-energy-future-almost/

[4] https://www.amazon.co.uk/Zeronauts-Breaking-Sustainability-Barrier/dp/1849713979

[5] https://www.mbenefits.eu

Friday 28 September 2018

On the 14th September I was very pleased to be able to present to the Association of Environment Conscious Building (AECB) Convention. It was a great event, based in a Passive House standard community centre and it was excellent to meet some old friends, as well as make new interesting contacts. It was also an excellent opportunity to visit two amazing passive houses.

The following is based on my slides and presentation:

Thank you for the opportunity to speak today. I have a long standing interest in low energy housing and in fact helped build some low energy self-build houses in the 1980s including a house at Energy World in Milton Keynes. I am here to talk today about how to shift capital away from energy supply to energy efficiency, and this is the topic I spend much of my time working on. I am going to try to paint the big picture, tell you about some things that are going on in this area, and hopefully leave you with some grounds for optimism.

I always start with this picture of the £50 and say “there is big money in energy efficiency”. I really hope they don’t withdraw the £50 note because I think it is the only bank note in the world that celebrates energy efficiency. If you travel around the world you see bank notes that celebrate oil and gas and even electricity but this one of course shows Matthew Boulton and James Watt. Contrary to what you may have learnt in school James Watt did not invent the steam engine but he did invent a more efficient steam engine, and Matthew Boulton was the entrepreneur who teamed up with him and turned that invention into a successful business. They did that by offering shared savings energy contracts, taking a share of the savings in coal that the new engine produced when pumping water out of mines. This is perhaps another example of a UK innovation that we have never really exploited properly, and even 250 years after this we still don’t really know how to exploit the massive potential for economic, cost-effective energy efficiency which is all around us.

So just how big is this potential? Over the decades there have been many, many studies of potential across many, many geographies and sectors. All of them show that there is massive potential that is not being exploited. Just to give one example, in 2012 the IEA published several scenarios including its Efficient Worlds Scenario. This estimated the potential for energy efficiency as 40% in buildings, 23% in industry and 21% in transport. Implementing this scenario would halve the rate of growth of energy demand and result in emissions peaking in 2020. Significantly the economic impact would be $18 trillion, which is more than the combined GDP of the US, Canada, Mexico and Chile in 2011. That is a lot of money.

If we are going to shift investment from energy supply to energy efficiency we need to consider the starting point so that we can measure progress. It is not easy to measure the global investment into energy efficiency but the IEA now does this on an annual basis. The IEA estimate that total global investment into energy efficiency in 2016 was $231 billion and the good news is that this is increasing. That is the good news. The bad news is that the IEA and IRENA estimate that to achieve their “66% 2°C” scenario would need to ramp up to almost $3 trillion a year in the 2040s, more than a factor of ten higher than the current level.

It is worth putting these big numbers into context. Total investment into the energy system was estimated at $1.8 trillion in 2017. A few highlights:

- investment in coal was $79 billion which was 13% down – and nothing Donald Trump does will stop that going down

- investment in electrical networks was $303 billion and this is expected to grow in the next few years as it includes storage

- investment in fossil fuel generation was $132 billion, down 9%

- investment in renewable generation was $298 billion which was down 7%. It is important to note, however, that the capacity installed in the year actually went up due to the falling costs of wind and solar generation.

- Oil and gas investment went up – probably in line with the oil price and because of the growth of investment in fracking. I will say, however, that the other day I was talking to a very experienced oil and gas investment banker and he said that it was now really difficult to raise money for new oil exploration and production companies in London, which traditionally has been one of the global centres for oil and gas funding.

Next it is important to be very clear that there is not a shortage of capital. Traditional energy efficiency people have tended to say “there is no money for our projects” but there is no absolute shortage of capital. Fitch Ratings reported that there is approximately $9 trillion of global government debt that trades at negative interest rates, i.e. the investors are paying to hold that debt. There is a wall of capital looking for good investments and an increasing share of that capital wants to invest in green projects. As there is an over-supply of funds the yield a project needs to generate to attract investment has come down.

So how to tip the balance of investment more in favour of energy efficiency? I am going to talk about two areas; changing the way we think about energy efficiency and making it more investable.

Changing the way we think about efficiency starts with thinking about it as an energy resource in exactly the same we think about other energy resources. Wallace Everett Pratt, a famous petroleum geologist said that “where oil fields are really found is in the minds of men”. When you think about it is true. When Edwin Drake first drilled for oil in Pennsylvania in 1859 people thought he was mad. The physical material was there all the time, in fact oil seeped to the surface and was collected, but sub-surface oil became realisable when someone thought it was there and assembled the technology and the resources to prove it. It is the same in energy efficiency. If you think about it there is an energy efficiency resource in every building, industrial plant and transport facility (except of course this passive building) but the resource is only there when you think about it, if you look at a building in a certain way you can see energy (and money) flying out through the roof, the walls, the doors and the windows.

In the oil and gas industry there is something called the Petroleum Resources Management System which sets out the different types of oil and gas resources and reserves. This has been standardised by the industry and is the basis of fund raising. If you have a prospective resource you can raise money on the back of it, it will be high risk money because you still have to drill holes and test it and even if oil is there you still need to work out a viable, financeable way of getting the oil out to market. We need to think about efficiency in these terms. A potential study is like a prospective resource. The output of an energy audit moves that resource into a contingent resource. Then some of the projects identified will be developed and ultimately move into production, that is production of savings of negawatt hours. Imagine if we could get the market to think about efficiency in this way. Building owners could lease their buildings open to efficiency exploration and production companies in exactly the same way that the owner of a field in Pennsylvania or Texas may choose to lease it to an oil and gas company. Owners of buildings could even hold auctions based on selling the right to explore the building for efficiency resources.

Energy efficiency has many barriers. There is a whole genre of research on barriers to energy efficiency. All of that is important work but there is one fundamental problem that energy efficiency has that the books don’t mention…….it is really, really boring. For most people, nearly everyone, it is tedious beyond belief. People just don’t care about it. Unless we recognise this we are kidding ourselves. So how do we overcome this?

The answer I believe is non-energy benefits. We only really started thinking about the multiple non-energy benefits of energy efficiency a few years back. Non-energy benefits include, amongst many others:

- better comfort

- better health outcomes

- better employee productivity / reduced absenteeism

- better plant productivity

- increased asset value

- reduced need for capex in energy supply

- poverty alleviation

- improved local air quality

- and many more.

We need to consider the impact of non-energy benefits and how people make decisions. Even in the corporate and investment world, where economics are critical, it has been found that profitability is not the main driver of investment decisions and that financial evaluation tools only play a secondary role in decision making. The strategic nature of a project or investment carries a heavier weight than just the economics. If an action is considered strategic there is much less consideration of the investment return. Therefore we need to make energy efficiency more strategic. Non-energy benefits such as comfort, productivity, increased resilience etc. are the way to do this as they are much more strategic and therefore much more interesting than simple energy cost savings. Nowadays I always say to people developing efficiency projects, work out what is strategic to the decision maker and stress those strategic benefits, only as an addition say “by the way you will also save some energy costs”.

There is an increasing amount of work going on around the world to value these non-energy benefits including several projects funded by the European Commission. Some are difficult to value but many have real and measurable value. Studies by the World Green Building Council and Rocky Mountain Institute have shown the value of benefits such as a reduction in sick days, higher asset values and reduced capex and build times.

To build better business cases we need to assess the value of energy savings, as we have always done, assess the financial value of non-energy benefits, and assess the strategic effect of the proposed investment. Putting these three elements together will make better business cases and better business cases help more capital will flow.

Of course I have been talking about capital investment in organisations. Individuals choosing houses exhibit some of the same characteristics. Evidence shows that people, and here we are talking about “ordinary” customers, not energy geeks or specialists, are sold on passive houses because they increase the overall quality of life by providing a quieter environment, better air quality, greater comfort and longevity.

Now I am going to turn to making efficiency more investable. Energy efficiency is hard to invest in for lots of reasons including:

- there is a lack of standardisation

- the outcomes rarely measured

- there is uncertainty i.e. the risks are unknown

- projects are small compared to needs of institutional investors

- there is a lack of capacity in financial institutions and CFOs – but also in the supply chain and amongst decision makers

- traditional contracting models like Energy Performance Contracts don’t actually work well – especially in the real estate, industry and residential sectors

Several groups and analysts including the Energy Efficiency Financial Institutions Group identified that lack of standardisation in the way that energy efficiency retrofit projects are developed and documented is a barrier to investment. Michael Eckhart of Citi, one of the world’s top “green bankers” said:

“Energy efficiency projects do not yet meet the requirements of capital markets. No two projects or contracts are alike.”

Lack of standardisation creates several problems for investors. It:

- increases performance risk

- increases transaction costs

- makes it hard to aggregate projects – aggregation is essential because energy efficiency projects are so small compared to the “cheque size” of financial institutions

- makes it difficult for a financial institution to build capacity – if a bank wants to deploy capital into energy efficiency it is hard to build human capacity and scale without standardisation.

An important response to the lack of standardisation is the Investor Confidence Project (ICP) which has a project certification system, Investor Ready Energy Efficiency™ (IREE™), which is based on best practice, is transparent and has independent certification by quality assurance professionals. We introduced ICP and IREE™ to Europe from the US a few years back with the assistance of the European Commission’s Horizon 2020 programme. The system is now up and running across Europe for energy efficiency projects in buildings, industry, street lighting and district energy. Its impact has been confirmed by Munich Re HSB who offer energy efficiency performance insurance. If you take them an IREE™ certified project they will offer a lower insurance premium and not require an independent engineering analysis (which the customer pays for), thus proving the thesis that IREE™ reduces risk and transaction costs.

I want to turning now to the role of banks and investors. There are four reasons why financial institutions should consider deploying capital into energy efficiency:

- it is a large potential market

- it can reducing risks in two ways:

- improving the cash flow of clients

- avoiding financing stranded assets

- it helps Corporate Social Responsibility

- banking regulations are increasingly looking at climate risks through bodies such as the Financial Stability Board Task Force on Climate-related Financial Disclosures (FSB TCFD)

The impact of risk reduction and the banking regulations will become more significant. If as seems likely banks will need to measure and declare their climate related risks it will drive banking behaviour. Having a mortgage portfolio dominated by high energy consuming houses will be higher risk than having a portfolio dominated by low energy houses and that could affect regulatory capital and the stress testing that you hear about nowadays.

Banks and investors are paying attention to this. The International Investors Group on Climate Change, which represents investors with more than €21 trillion of assets under management supports energy efficiency. In Europe, as well as the work of the Energy Efficiency Financial Institutions Group we have a number of financial institutions that are leading the way. ING Real Estate, which has c.€50 billion lending to commercial real estate, has developed an app to help its borrowers assess the potential for improvement and offers higher Loan to Values for high efficiency portfolios as well as cheaper money for efficiency improvements. They see this as a) good business and b) reducing the risk of stranded assets as the Minimum Energy Efficiency Standards in the Netherlands progressively tighten.

Another important European initiative is the European Energy Efficient Mortgages Plan which is backed by the European Mortgage Federation, the European Covered Bonds Council and Horizon 2020. It is developing a standard energy efficiency mortgage for Europe. This is a challenge but will enable scaling which ultimately will allow refinancing through issuing green bonds, an asset class that is much in demand by institutional investors.

Finally I want to talk about creating a level playing field and a real market for energy efficiency. The market for energy is clear and functional, like all markets it is based on standard units, known risks, standardised contracts and liquidity. We often talk about the market for energy efficiency but I can tell you categorically there isn’t one – there are only markets for stuff like boilers or insulation. I can call an energy broker or sit at a Bloomberg terminal and buy some energy in the energy market but I can’t buy energy efficiency. That is a major barrier.

Now, with the advent of smart meters, cloud computing and big data we are starting to see the emergence of tools and regulatory systems that can create a real market for energy efficiency. In California now, and increasingly in other states, utility regulators are introducing metered efficiency and ‘pay for performance’ models where payments are based on actual metered results and not just on the basis of installing a piece of kit. We are now working with OpenEE, the pioneer of this approach, to bring it to the UK and Europe. We believe that it has the potential to transform the energy efficiency world by making efficiency a reliable, contractable, distributed energy resource that utilities can rely upon and easily invest in.

So, finally, looking to the future, I see that we are moving:

- from justifying energy efficiency on cost savings alone to justifying energy efficiency on the basis of its strategic non-energy benefits

- from a world where energy efficiency was considered to be “no risk” to a world where we understand the real risks of efficiency projects

- from a situation where basically efficiency is a pain to utilities to one in which it is a reliable, contractable distributed energy resource

- from a world where it is hard to invest in energy efficiency to one where it is easy to invest in

- from a global annual investment in energy efficiency of c.$250 billion to more than $1 trillion a year.

Thank you.

Dr Steven Fawkes

Welcome to my blog on energy efficiency and energy efficiency financing. The first question people ask is why my blog is called 'only eleven percent' - the answer is here. I look forward to engaging with you!

Email notifications

Receive an email every time something new is posted on the blog

Tag cloud

Black & Veatch Building technologies Caludie Haignere China Climate co-benefits David Cameron E.On EDF EDF Pulse awards Emissions Energy Energy Bill Energy Efficiency Energy Efficiency Mission energy security Environment Europe FERC Finance Fusion Government Henri Proglio innovation Innovation Gateway investment in energy Investor Confidence Project Investors Jevons paradox M&V Management net zero new technology NorthWestern Energy Stakeholders Nuclear Prime Minister RBS renewables Research survey Technology uk energy policy US USA Wind farmsMy latest entries