Wednesday 9 October 2019

September saw the launch of the Three Percent Club, a coalition of countries, businesses and international organisations committed to driving a three percent improvement in global energy intensity each year. Launched at the UN Climate Action Summit in New York, the Three Percent Club seeks to address the fall in the annual improvement in energy intensity to just 1.3% in 2018, and International Energy Agency research showing that the right efficiency policies could deliver over 40 percent of the emissions cuts needed to reach the goals of the Paris Agreement, without requiring new technology.

So how do we achieve this annual level of improvement in energy efficiency? Improving energy efficiency fundamentally comes from three things;

- improving the efficiency of existing assets – the buildings, processes and systems we already have – through improved energy management (without significant investment into new equipment).

- improving the efficiency of assets and systems through investment into energy efficiency, investment that can either be purely driven by the desire to improve efficiency (retrofit), normal end of life upgrades (renovation), or investment in new facilities such as buildings and industrial processes.

- changing the mix of the economy to more energy efficient goods and services.

To improve energy management of the existing assets we need to improve training in energy management and increase appreciation of the value of good energy management in the C-suite. Systems such as ISO 50001 can help do this. Policy measures should encourage the use of ISO 50001, through mechanisms such as Ireland’s Large Industry Energy Network, the US’s Superior Energy Performance programme or Sweden’s programme for Improving Energy Efficiency in Energy-Intensive Industry which provides a waiver on energy tax for companies that implement ISO50001 and other measures. We also have to recognise that in many organisations energy management is under-staffed and so the use of newly emerging AI systems to optimise energy use in buildings and processes will become more attractive as they get cheaper and more capable.

Clearly we need to increase the rate of investment into energy efficiency in all forms but we also need to improve the quality of energy efficiency investments. Quality is improved by using standardised, state of the art, project development methodologies such as the Investor Confidence Project’s Investor Ready Energy Efficiency™ to develop projects that perform better. We can increase the depth of savings from investments by adopting integrated design techniques, an approach that is still woefully under used.

We also have to recognise that there are limits to how far any building or process can be improved by retrofitting. End of life renovation provides an opportunity to improve efficiency, an opportunity that is often missed or under-used. Once a major renovation happens the fundamental level of energy efficiency is locked in for a long period, twenty to thirty years or even more. It is critical that we make the most of each and every one of those opportunities to maximise the improvement in energy efficiency. This requires several things; policies that drive maximum efficiency, and building capacity in the C-suite to ensure customers demand the highest levels of efficiency. A third important factor would be banks and financial institutions lending for these kinds of projects working to ensure higher levels of efficiency than simply ‘business as usual’ are achieved. Banks such as ING commercial property division already do this by providing assistance and refusing to lend to low performing buildings. ING and other financial institutions see this as a risk reduction strategy, a way of generating additional business and a way of having an environmental impact. For building and industrial process owners just building a new facility to legal requirements (either planning requirements or even current best practice) and claiming it as energy efficient is not good enough, owners need to demand the highest levels of efficiency and low carbon energy supply – this does not mean untested technology, just using existing technology in the best way.

We need to build capacity on the demand side, the supply side and in the finance community. We need to ensure the C-suite knows what is possible and actually demands high quality energy management programmes, high quality investments into efficiency and the use of integrated design. Leading companies including Johnson Controls, Schneider Electric and 3M have achieved more than 3% improvement in energy productivity per annum year after year, in some cases for several decades so it can be done. We also need to build capacity in the financial sector to understand, evaluate and invest into energy efficiency.

Changing the mix of the economy to more energy efficient goods and services is another area that we should not forget. Dematerialisation and integration of devices e.g. smart phones replacing cameras, radios and just about everything else, helps. Switching to renewable energy supplies greatly helps as the inherent inefficiency of thermal power stations – driven by the laws of thermodynamics – is replaced by direct generation with no thermal processes with their massive losses.

The Three Percent Club is a way of focusing attention on the problem with a clear target against which progress can be measured. EnergyPro supports this new initiative fully – if you want to support it too you can sign up here.

Friday 6 September 2019

For anyone wanting to understand how the world changes Thomas Kuhn’s concept of paradigm shifts, as put forward in his 1962 book ‘The Structure of Scientific Revolutions’, is essential reading, even though it was originally applied to shifts in scientific thinking it is applicable far beyond science.

In its entry on Kuhn, the Encyclopaedia Britannica explains his concept:

“Scientific research and thought are defined by ‘paradigms’, or conceptual world-views, that consist of formal theories, classic experiments, and trusted methods.

“Scientists typically accept a prevailing paradigm and try to extend its scope by refining theories, explaining puzzling data, and establishing more precise measures of standards and phenomena. Eventually, however, their efforts may generate insoluble theoretical problems or experimental anomalies that expose a paradigm’s inadequacies or contradict it altogether.

“This accumulation of difficulties triggers a crisis that can only be resolved by an intellectual revolution that replaces an old paradigm with a new one. The overthrow of Ptolemaic cosmology by Copernican heliocentrism, and the displacement of Newtonian mechanics by quantum physics and general relativity, are both examples of major paradigm shifts.”

In short the concept says that things change in paradigm shifts rather then gradually. In the period that Kuhn called ‘normal science’, everything looks fine. Then cracks appear when some evidence arrives that things are not quite how they appear to be. In that phase the majority of people who are attached to the paradigm resist, rubbishing the people attacking the existing theory. Over time the weight of evidence builds until the new paradigm emerges and is accepted by the majority.

The idea transformed scientific debate and modelling.

Clearly the world of energy supply has undergone a paradigm shift over the last 10 to 20 years. In the old paradigm renewables were regarded as expensive and only ever to be a small percentage of supply, people who argued otherwise were criticised by the energy establishment for being unrealistic. Now we are seeing renewables under-cutting fossil fuelled generation and generating a growing proportion of electricity supply. The defenders of the old paradigm, particularly people like Trump and the coal companies in the US, continue to attack the new paradigm but it is now clear that they are on the wrong side of history. It is normal during a paradigm shift for the ‘old guard’ to fight hard to defend their view of the world, even as the evidence mounts that it is wrong. Attacks on those working to shift the paradigm are normal. Other aspects of the old energy paradigm that are breaking down include; supply reacts to demand, there is a merit order in which generators bring on different supply sources with coal and nuclear delivering ‘base load’, and electricity cannot be stored.

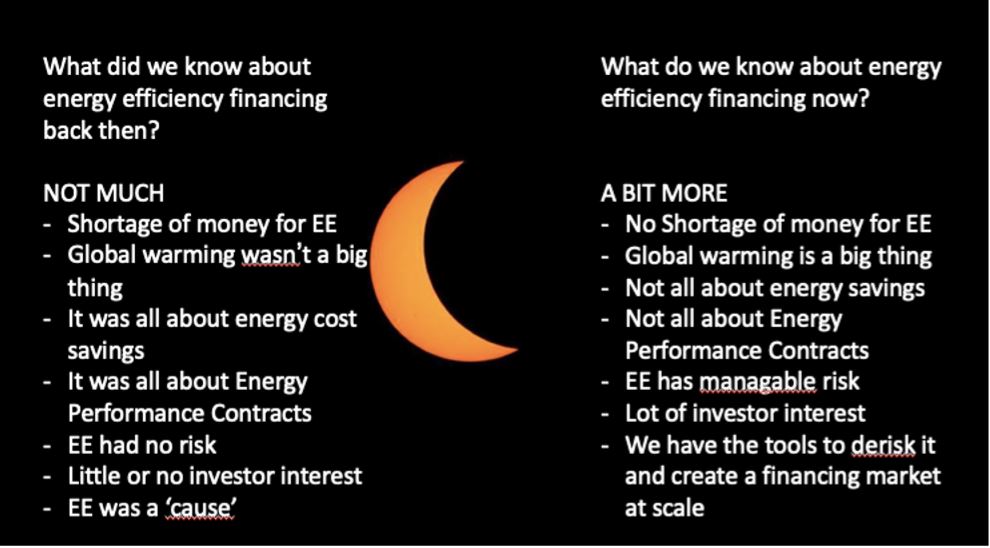

We are also now seeing a shift in thinking about energy efficiency that heralds a paradigm change. The old paradigm was dominated by the idea that efficiency needed encouragement over and above market forces. It was also based on the idea that efficiency projects were developed in non-standard ways and that the measurement of the result was difficult, and that large programmes came with large measurement and verification costs. In the US a whole industry developed to estimate the results of efficiency programmes. As specific project measurement was rare the actual results of many projects were unknown. Furthermore, often when they were measured results were a long way from what was planned, the ‘performance gap’.

Other characteristics of the old and emerging paradigms are shown below.

| Old paradigm | Emerging paradigm | ||

| Energy efficiency is a ‘cause’ or a ‘campaign’ that needs special support programmes. | Energy efficiency can operate in a market where it truly competes with energy supply. | ||

| Measurement of individual projects result is expensive and hard. | Measurement of individual project results, and portfolios of projects, is cheap and easy. | ||

| The outcome of projects have large uncertainties. | Uncertainties can be reduced by standardisation of project development and implementation, as well as by learning from results. | ||

| Efficiency is evaluated purely on value to the end user. | Efficiency is evaluated on value to the end user and the energy distribution system | ||

| Efficiency is somehow special and separate to other areas such as demand response and distributed generation. | Efficiency is one of several tools for optimising costs, energy use and emissions for the end user, and also for the energy distribution system. | ||

| Savings from an energy efficiency measure are considered to be spread out equally over a year. All units saved have the same average value. | Savings from an energy efficiency measure occur at specific times, times that have an impact on the supply system. Therefore units saved have different values at different times. | ||

| Buildings and other users are simple consumers of energy. | Buildings and other users can be consumers or suppliers of energy. | ||

| Energy demand patterns are fixed. | Energy demand patterns are flexible. | ||

| The value of energy efficiency is simply cost and emission reductions. | There are multiple, strategic sources of value for an energy efficiency investment. | ||

| There are diminishing returns in efficiency investment. | Through integrative design it is possible to have an expanding, declining cost efficiency resource. |

In the US the emergence of the new paradigm is being enabled by policy switches to support metered efficiency programmes in which results of investments are measured and payment is based on results, Pay for Performance. If we are to achieve the real potential of efficiency to reduce emissions, as well as make our use of energy, more productive, policy makers everywhere need to take this approach, despite the resistance of the old guard.

EnergyPro is looking to work with forward looking energy suppliers, energy service companies, efficiency product companies, or others wanting to explore the new business opportunities the paradigm is creating globally.

If you are not prepared for the paradigm change, once it happens, you may well be out of business.

Friday 30 August 2019

I have recently read many of the Apollo 11 50th anniversary related books and some of them even had new information I didn’t know even after spending my whole life studying the Apollo programme. That is one of the good things about Apollo, it was so big, there are always new stories to read. However, I digress. I was once again struck by the eloquence of John F. Kennedy’s two oft quoted speeches on space; the address to Congress on 25 May 1961 and the “We choose to go to the moon” speech at Rice University on 12 September 1962, and how they could form the basis of a speech that a hypothetical future US president (or other national leader) could use to address climate change.

Some examples from the address to Congress:

“These are extraordinary times. And we face an extraordinary challenge.”

“No role in history could be more difficult or more important.”

“There is no single simple policy which meets this challenge. Experience has taught us that no one nation has the power or the wisdom to solve all the problems of the world or manage its revolutionary tides — that extending our commitments does not always increase our security — that any initiative carries with it the risk of a temporary defeat — that nuclear weapons cannot prevent subversion — that no free people can be kept free without will and energy of their own — and that no two nations or situations are exactly alike.

Yet there is much we can do and must do. The proposals I bring before you are numerous and varied. They arise from the host of special opportunities and dangers which have become increasingly clear in recent months. Taken together, I believe that they can mark another step forward in our effort as a people. I am here to ask the help of this Congress and the nation in approving these necessary measures.”

“All that I have said makes it clear that we are engaged in a world-wide struggle”

“I believe we possess all the resources and talents necessary. But the facts of the matter are that we have never made the national decisions or marshalled the national resources required for such leadership. We have never specified long-range goals on an urgent time schedule, or managed our resources and our time so as to insure their fulfillment.”

“No single space project in this period will be more impressive to mankind, or more important for the long-range exploration of space; and none will be so difficult or expensive to accomplish.”

“A second real asset is that we are not alone. We have friends and allies all over the world who share our devotion to freedom.”

And from the Rice University speech:

“William Bradford, speaking in 1630 of the founding of the Plymouth Bay Colony, said that all great and honorable actions are accompanied with great difficulties, and both must be enterprised and overcome with answerable courage.”

“We choose to go to the moon. We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win, and the others, too.”

It is easy to see how these phrases could be co-opted to cover climate change, even if that can only be a dream itself until the current Administration is consigned to history and the better sides of America become dominant again.

The other phrase that always comes up in discussing Apollo is “if we can land a man on the moon why can’t we…….. (complete with your preferred problem)”. The phrase, the first recorded use of which apparently was in 1962 even before the US had flown John Glenn into orbit, is still in use. In my last blog I did hint at the inspiration Apollo could provide to solving climate change. Although I have never thought a single centrally led programme was the right approach there is a need for inspired leadership as shown by JFK. Political and corporate leadership is still needed, even though we have entered the age when many of the solutions such as renewable energy are actually economic compared to the incumbent technologies and so markets will drive change. We need leadership to drive rapid change.

In one of the best 50th anniversary books, “One Giant Leap”, Charles Fishman addresses how Apollo changed the world. He specifically writes about what lessons Apollo has for dealing with complex social and economic problems such as homelessness, environmental problems or even climate change, an important topic for debate as back in the 1960s and 70s NASA’s programme management approach was once seen as a solution to these kinds of problems. He says something that I think is true:

“If we want to tackle climate change, we can. It can’t be solved with “a moonshot,” in the sense that Apollo was solved with a series of brilliant technical, engineering, and management efforts. But it can be solved with a moonshot in the sense of rallying Americans” (and I would add people in all countries) “to a purpose, to a mission, to something that takes incredible effort. With leadership and clarity of purpose. We just need to be asked”.

Tuesday 16 July 2019

Even for those with no interest in space exploration it must be hard to avoid the fact that this month is the 50th anniversary of Apollo 11 making the first landing on the moon. As regular readers know I have a strong interest in space and particularly the Apollo programme and so as in previous years I have to mark the anniversary in some small way.

Whichever way you look at it Apollo 11 – and the entire Apollo programme – was an incredible achievement, the result of eight years of dedicated, focused effort from up to 400,000 people, marshalled and directed by a government agency co-ordinating hundreds of contractors and sub-contractors. What can we learn from Apollo half a century on?

First of all there is the importance of a clear objective. President John F. Kennedy set out the objective in his speech to Congress on 25th May 1961, at which point the US had the grand total of 15 minutes of crewed sub-orbital space flight experience: “First, I believe that this nation should commit itself to achieving the goal, before this decade is out, of landing a man on the moon and returning him safely to the Earth.” This crystal clear objective came to be shortened as “man, moon, decade” and served as the touchstone for the programme and of course was achieved on 24th July 1969 when Apollo 11 splashed down in the Pacific and Neil Armstrong, Buzz Aldrin and Michael Collins were safely recovered onto the aircraft carrier USS Hornet.

Another lesson is the value of leadership taking bold steps. Throughout the Apollo programme political and programme leaders, exhibited boldness of a level which seems near impossible today. Douglas Brinkley in “American Moonshot” describes John F. Kennedy’s philosophy of courage as being “life is short, bold steps forward are immortal, so act.” The whole idea of landing on the moon inside a decade was so bold, especially so early in the development of space technology, that even many NASA managers were shocked by the commitment. The technology did not exist, even the method of getting to the moon (Lunar Orbital Rendezvous) was not decided until July 1962 – it was another three and half years before the ability to actually rendezvous in space at all was demonstrated by Gemini VI and VII. NASA’s decision to send Apollo 8 into lunar orbit in December 1968, driven partly by intelligence that the Soviet Union was planning a manned lunar flyby and by delays in the Lunar Module was incredibly bold. Apollo 8 was only the second manned Apollo flight and only the third launch of the monstrous Saturn V. The idea of sending Apollo 8 to the moon started in August 1968 with a final decision in November, after Apollo 7 had met its objectives in Earth orbit. In the four months before the mission the flight plan had to be developed, software written and the crew and Mission Control trained for a new mission.

Another lesson from Apollo is that exploration is hardwired into human DNA. Although the timing of the Apollo programme was driven by Cold War rivalries the idea of going to the moon and beyond is a centuries old dream. The advances in technology, many of which we are benefitting from today, and the scientific harvest were immensely valuable, but we explore because it is in our nature. Otherwise we would still be living in trees, or the ocean. Although we clearly need to address problems on earth we cannot suppress the desire to explore the solar system and beyond.

The power of purpose in organisations is now beginning to be recognised. Apollo – and space exploration – gave many people a higher purpose, one for which they were prepared to make great personal sacrifices. Admittedly there was no idea of life-work balance back then and many individuals and families paid a very high price but it was a choice made for a higher purpose. Some people of course, including astronauts and workers gave their lives.

In summary we can learn a lot from Apollo. We certainly need clear objectives to solve our environmental and social problems and we need bold leadership, something that appears lacking today – at least amongst politicians. Of course we also need the long-term financial commitments that underpinned Apollo – as JFK said in a less well known part of his speech to Congress, “I am asking the Congress and the country to accept a firm commitment to a new course of action, a course which will last many years and carry very heavy costs”. Yes, the programme was expensive, although tiny compared to defence spending, but its yield in terms of new technology, science, STEM education and the inspiration of generations of scientists and engineers was huge and continues to this day.

Having studied every detail of the Apollo programme I could find for more than fifty years I still find it incredible and the more I learn the more amazing it is. Even if you are not that interested in space I highly recommend reading at least one of the books or seeing at least one of the films commemorating the Apollo 11 anniversary. I recommend; “American Moonshot” by Douglas Brinkley, “Apollo 11 The Inside Story” by David Whitehouse and “Chasing the Moon” by Robert Stone and Alan Andres, which is also a documentary shown on PBS and the BBC. If you only do one thing see “Apollo 11” which tells the whole story of Apollo 11 in archive footage and includes some previous unseen 70mm film that was locked away for years and forgotten. Watch it and be amazed.

Wednesday 19 June 2019

One of the most memorable phrases I first heard at the ACEEE Finance Forum in 2012 was that ‘the problem with efficiency financing is that the ratio of conferences to deals is too high’. That remains true although there are good signs that the ratio is improving, the number of conferences seems the same (or maybe higher) but the number and value of deals is definitely increasing in lots of places around the world. On my recent trip to Bucharest for the 2nd Round Table on Energy Efficiency Financing held under the auspices of the Sustainable Energy Investment Forum I saw more evidence of this change. The meeting was encouraging because a) several banks were in the room leading the conversation (& deals) and b) there are a now a number of successes to point to.

The first of these was a UNDP Global Environment Facility project which I had a small part in designing when I first went to Bucharest in the 1990s and was implemented from 2003 through to 2006. This project was executed extremely well with only $2m of UNDP money which supported project development assistance and capacity building, and yet catalysed nearly $70m of private investment into 34 energy efficiency projects, compared to a target of $12.5m and 20 projects. Although I had not developed my jigsaw of energy efficiency financing back then on reflection the project had the four pieces of the jigsaw, finance (development and project), building pipelines, standardisation, and capacity building within the demand side, the supply side and the finance industry. The implementing consultants carried out activities in all four areas. Although it is now a long time ago, the project merits study for anyone designing programmes designed to catalyse private investment using a small amount of public money.

Since the UNDP GEF project there has been a series of EBRD Green Economy Financing Facility (GEFF) facilities that ran between 2008 and 2018; the Energy Efficiency Finance Facility (EEFF) – for private sector industrial companies, the Municipal Fund for Energy Efficiency (MFFEE) – for municipalities, and the Romania Sustainable Energy Finance Facility (RoSEFF) which financed projects in SMEs. These facilities provided technical assistance to help develop and close projects and used a mixture of grants from the EU (between 10% and 20%) and loans to finance projects. The EEFF made 129 investments totalling €111m, the MFFEE deployed €10m into three public lighting schemes, and the RoSEFF made 341 investments totalling €69m. The current GEFF in Romania was launched in 2017 and is a €100m financing framework for the household sector, the first time this sector has been specifically addressed. Concessional financing is provided by the TaiwanICDF through EBRD to local financial institutions Banca Transilvania and UniCredit Bank and to date $64m has been deployed. The facility consultant, Tractebel, trains local financial institution branches how to recognise and act upon energy efficiency lending opportunities which builds capacity and ensures extensive outreach throughout the branch network.

The other exciting project is the Romania Green Building Council’s ‘Smarter Finance for Families’. This project developed a low-cost, local green home certification system in which homes have to achieve an energy performance more than 30% better than an A rated home and have other green features including use of non-toxic materials and reduced construction waste. Furthermore the scheme links this to green mortgages from major banks which offer lower interest rates for homes certified to the standard. The programme now accounts for about 10% of total new home building in the country. This would have been unimaginable back when I worked in Romania in the mid-1990s and is a great achievement by the Romania GBC who are now replicating it in 11 countries with the support of a Horizon 2020 funded project. Like the other successful projects it has the four elements of the energy efficiency financing jigsaw.

The last time I had been in Bucharest was for the total solar eclipse on 11 August 1999 and after twenty years away it was great to see some old friends and colleagues as well as the big changes in Bucharest, which is a lot more pleasant to be in than it was back then. There is a lot of building rehabilitation underway, rehabilitation that has to improve earthquake resistance as well as thermal performance. Much work needs to be done to increase the flow of capital into increasing the performance of the building stock in all aspects but that applies everywhere. The country is moving in the right direction and the continuing dialogue between banks and other stakeholders catalysed by events such as the Roundtable, coupled with the available tools such as the Romania Green Building Council standards, the Investor Confidence Project, the EEFIG Underwriting Toolkit and the Derisking Energy Efficiency Platform (DEEP), will help accelerate the trend.

Although I greatly enjoy speaking at conferences our real work is working to improve the ratio of projects to conferences – that is getting more investment into energy efficiency. If you share this mission and want to discuss how EnergyPro can help you let me know.

Dr Steven Fawkes

Welcome to my blog on energy efficiency and energy efficiency financing. The first question people ask is why my blog is called 'only eleven percent' - the answer is here. I look forward to engaging with you!

Tag cloud

Black & Veatch Building technologies Caludie Haignere China Climate co-benefits David Cameron E.On EDF EDF Pulse awards Emissions Energy Energy Bill Energy Efficiency Energy Efficiency Mission energy security Environment Europe FERC Finance Fusion Government Henri Proglio innovation Innovation Gateway investment in energy Investor Confidence Project Investors Jevons paradox M&V Management net zero new technology NorthWestern Energy Stakeholders Nuclear Prime Minister RBS renewables Research survey Technology uk energy policy US USA Wind farmsMy latest entries

- The corruption of purpose in business – and how to address it

- Gee, I wish we could have a white Christmas, just like the old days….

- A look back at the last forty years of the energy transition and a look forward to the next forty years

- Domains of Power

- Ethical AI: or ‘Open the Pod Bay Doors HAL’

- ‘This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning’

- You ain’t seen nothing yet