Friday 7 April 2017

Having written and talked about the Bullitt Center in Seattle and the Metered Energy Efficiency Transactions Structure (MEETS) which it pioneered it was great to finally visit this impressive building during my recent trip to the US. I was lucky enough to be given a personal tour by Denis Hayes, President and CEO of the Bullitt Foundation and noted environmentalist, best known as the co-ordinator of the first Earth Day in 1970 and Head of the Solar Energy Research Institute (now NREL) during the Carter administration.

The six storey, 52,000 square feet building was designed and built for the Bullitt Foundation, which exists to “to safeguard the natural environment by promoting responsible human activities and sustainable communities in the Pacific Northwest”. The Foundation needed new office accommodation and wanted something more appropriate to its mission than its old offices in a historic building.

The decision was taken to build a cutting edge sustainable building that would both house the foundation but also serve as a commercial building. When talking to designers and leading green developers the foundation team were told that their aspirations of a net energy positive, sustainable building for the same (or less) cost than a normal class A building was impossible. Having been told it was impossible the foundation persevered and achieved all their goals. After reviewing different green building standards Denis Hayes settled on using the Living Building Challenge. To fulfill the requirements of the Living Building Challenge a building must demonstrate 12 months of operational performance according to 20 Imperatives distributed amongst seven “petals”: Site, Water, Energy, Health, Materials, Equity, and Beauty.

On energy the design called for net energy positive and an Energy Use Intensity (EUI) of 16 (measured in the quaint US units of kBtu/square feet/year), equivalent to the output of the 244 kW rooftop PV installation. This should be compared to the following EUI benchmarks:

- average for all Seattle office buildings: 92

- Seattle energy code building: 50

- Medium Office designed to ASHRAE 90.1 – 2007 (all climates): 47.7

- LEED Platinum building: 34.

When the building was commissioned the EUI was certified as 12.3, a 74.2% saving from the ASHRAE Medium Office benchmark. With the building 85% occupied the actual EUI is 10.

Much effort was put into the glazing and lighting design with the aim of maximizing the use of daylight. On average the building is 40% glazed with the main daylighting facades having 60% glazing. The triple paned argon filled, low-E glass windows are in vertical strips to maximize daylight. External shades keep out excessive solar gain and at night the windows can open to allow warm air out. A ground source heat pump system delivers heat and occasional additional cooling on the rare hot days in Seattle.

On water the target was simple – net zero water. Despite Seattle’s reputation as being the wettest place in the US it’s average-annual rainfall is less than several other major cities. Beneath the PV array a membrane roof takes rain water to drains that flow into a 56,000 gallon cistern in the basement.

Rainwater from the cistern is pumped through several increasingly fine filters and then exposed to UV light before passing to showers and taps. Interestingly, beyond the technical difficulties, the water system faced bureaucratic and legal issues. The building had to be established and regulated as an independent water system separate from, but surrounded by the City of Seattle’s municipal water system. Grey water is treated by filters and a green roof. Perhaps the most challenging aspect of the water system is the use of composting toilets with on-site black water treatment.

The health petal was addressed by avoiding paints with Volatile Organic Compounds, including biophilic elements, and utilizing radiant floor slabs for heating and cooling.

The materials petal started with wanting to avoid the Red List, a listing of fourteen categories of materials that the International Living Future Institute prohibits in any Living Building. To help meet this goal the number of materials to be used was minimized but it still took two years to research, co-ordinate and source materials. The building sits on a concrete base but above the third floor all framing is from heavy timber 100% certified by the Forest Stewardship Council, (as is all wood in the building). Concrete formwork used salvaged plywood and plastic tree fencing, which is used to protect trees during construction, utilized fencing used on other nearby projects rather than new plastic netting shipped from China. The Living Building Challenge imposes strict requirements on the distance different materials are allowed to travel to get to the project site, requirements that the Bullitt Center met.

The Bullitt Center integrated approach to addressing the Living Building Challenge is both technically and aesthetically attractive. It is nearly fully leased to a range of tenants including an engineering firm, a technology company amongst others – proving the economic argument as well as the environmental arguments. It is a truly a landmark project and a great example of what can be done with a highly motivated client and a design team truly prepared to truly push the envelope.

Thanks to Rob Harmon of the MEETS Coalition and Denis Hayes of the Bullitt Foundation for taking the time to show me the building. You can check out the performance of the Bullitt Center at: http://buildingdashboard.com/clients/bullittcenter/

Tuesday 14 March 2017

The level of investment in energy efficiency required to meet climate and energy security targets is significantly higher than both the current levels, and the levels that can be financed by public capital. In order to scale up energy efficiency to the levels that we know are possible, and we know are needed, we need to change the game and make energy efficiency into something that people want to buy, and something that can be easily financed by institutional capital at scale.

The barriers to scaling up investment into energy efficiency are now well documented. To name just a few: projects are small, the methods of developing and documenting project development are not standardised, capacity within the financial sector to understand value and risks of energy efficiency is limited, and traditional business models such as Energy Performance Contracts are not attractive in many segments of the market. As Michael Eckhart of Citi said; “energy efficiency does not meet the needs of the capital markets”.

There are signs, however, that the foundations of a functioning energy efficiency financing market are now being put in place. The Investor Confidence Project is rolling out its Investor Ready Energy Efficiency™ project certification system in the US and Europe, with growing interest from India, China and Australia and New Zealand. The EU’s Energy Efficiency Financial Institutions Group (EEGIG) is soon to launch its “Value and risk appraisal framework for energy efficiency finance and investments”, a guide to under-writing energy efficiency projects in buildings and industry. Investors and lenders are expressing more interest in developing energy efficiency related products. In the US Property Assessed Clean Energy (PACE) continues to grow and PACE loans are now regularly being securitised.

To build upon these foundations we need to ensure that four components are brought together in the same place at the same time by entrepreneurial individuals and organisations. The four components are; finance (for projects and development), standardisation, large-scale pipelines, and capacity building on the demand side, the supply side and within the financial sector. Project finance is abundantly available and much of it is seeking environmentally conscious or green homes – the issue right now is a lack of projects. Many failed energy efficiency finance schemes prove that project finance alone is not enough.

There is a need to finance the development of projects, that risky stage between “here is a good project idea” and “here is a fully developed bankable project”. Development capital is always high risk and there is an argument for using public capital to support this stage, although of course this does not generally happen in other sectors like property or power generation so it is questionable why it should in energy efficiency. The efficiency sector generally lacks a development mentality and eco-system and so public capital could be used to kick-start the development market using low cost convertible loans or grants such as the EU’s Project Development Assistance.

Standardisation in the development and documentation of projects is now available through the Investor Confidence Project. Currently available for buildings in the US, Canada and across all countries of Europe, the Investor Ready Energy Efficiency™ project certification system is there to be used. As it brings reduced due diligence costs and greater certainty of outcome, project developers, clients and financiers will increasingly require its use.

There is a lack of large-scale pipelines that can attract institutional capital. Energy efficiency projects tend to be developed on a building by building or site by site basis rather than across portfolios. In the 1980s and early 1990s large scale energy management programmes were implemented across many public and private sector portfolios but that skill and activity seems to have been lost. We are still in the pilot project mentality all too often. To develop large pipelines requires several things. Firstly it needs entrepreneurial efforts to acquire and build pipelines. Secondly, it needs attractive and simple business models that really make sense for clients. Existing models such as Energy Performance Contracts do not make sense for large parts of the market. Emerging models such as Efficiency Services Agreements, metered efficiency and Pay for Performance are more attractive and need to be developed and deployed. Finally, it needs strong leadership from client organisations and those that convene portfolio holders such as central, city and local governments to demand effective action at scale.

Capacity building amongst clients – the demand side – needs to focus on the energy and non-energy benefits of improved energy efficiency and the availability of financed solutions. Non-energy benefits such as increased asset value or improved health and well-being need to be stressed above just energy costs savings as they are usually much more interesting and strategic to most organisations. On the supply side capacity building needs to focus on developing standardised and bankable projects with consistent results. Within the financial industry capacity building needs to be focused on understanding the nature of efficiency, understanding the sources of value and the risks, as well as on the different ways that energy efficiency can be made into a financeable asset – all subjects covered in the EEFIG under-writing guide.

Pulling these four components together requires entrepreneurial effort – effort that can come from the public and/or private sectors – and can manifest itself in different organisational forms. Successful organisational forms include, but are not limited to, procurement frameworks, super ESCOs and retrofit accelerators. Successful procurement frameworks that can be used as models include the UK’s Carbon and Energy Fund which develops and helps finance large scale projects within the National Health Service. Through its framework it delivers finance, the pipeline, capacity building and standardisation (based on the Investor Confidence Project’s system). In the US there are several retrofit accelerators which bring together the different elements. In Dubai and India there are Super-ESCos, Etihad in Dubai and EESL in India. Both have successfully brought the four components together to deliver large-scale energy efficiency programmes and are good models for Europe and the US.

Massively scaling up investment into energy efficiency remains one of the biggest financial opportunities on the planet as well as the best opportunity to improve environmental conditions and reduce the threat from climate change. Even at current low energy prices the world spends some USD 5-6 trillion a year on energy. Entrepreneurs need to work to deliver new localised and national organisational forms that bring together the four components and deliver investment projects that significantly reduce energy spend, and bring multiple other benefits.

Monday 6 February 2017

On 1st February I made a keynote address at COWI, the Danish engineering company, at an event to launch their new tool to help value the multiple benefits of energy efficiency and other projects.

Good afternoon. I am going to start by saying we are in the midst of a revolution – and I don’t mean the revolution going on in Washington DC. The revolution I am talking about is an energy revolution. The old model was the large centralised energy plant sending energy out over a network to consumers. The new model is one which has two chief characteristics. Firstly there is a diversity of technologies including renewables, distributed generation, energy efficiency technologies, storage, and smart controls. Secondly there is a multi-directional model in which there are no longer producers and consumers but rather prosumers.

This revolution has already had a major impact on traditional utilities. In 2013 the Economist had a story headline on utilities, “How to lose half a trillion euros”. The number has gotten bigger since then. The good news is that there is big money in energy efficiency. The World Business Council on Sustainable Development estimated that the energy efficiency in buildings opportunity is worth $0.9 to $1.3 trillion – yes trillion. So this is a massive opportunity. However, everywhere I go in the world I find a sense of frustration, frustration that the market for energy efficiency investment is not growing fast enough. Why is that?

There is a massive gap between on the one hand the huge potential for cost-effective projects to improve efficiency, a potential that only needs proven technologies, and the massive amount of capital that is looking for profitable investments, especially investments with a green aspect. This is the gap we have to bridge. Just in case anyone is unconvinced about the availability of capital, a report from PIMCO stated that there is $12 trillion of institutional capital in global investment grade bonds trading with negative yields and that 15% of bonds within the Barclays Global Aggregate, (a widely used benchmark), was trading with negative yields to maturity. This huge amount of capital could be usefully deployed into energy efficiency and other green projects. The demand for green investments is growing rapidly as witnessed by the rise of green bonds.

So how do we start to deploy more capital into energy efficiency? My view is that there is a jigsaw of energy efficiency financing with four pieces; finance, building pipeline, standardisation and building capacity. Any project or programme, whether it is funded by public or private funds, needs to address all four parts of the jigsaw.

Let me start with standardisation. Many studies and market observers have highlighted the lack of standardisation in energy efficiency to be a major barrier to scaling up investment. The Energy Efficiency Financial Institutions Group (EEFIG) identified this and Michael Eckhart of Citibank has identified it by saying “energy efficiency does not yet meet the needs of the capital markets. No two projects or contracts are alike”. The importance of standardisation was brought home to me by a quote from D.E. Purcell who said: “Standards are like DNA. They are the basic building blocks for all technology and economic systems.” We could not have had the industrial revolution without standardisation and we could not have any financial market without it.

So why do we need to standardise?

Lack of standardisation introduces a number of problems:

- it increases performance risk

- it introduces uncertainty which in itself reduces demand

- it increases transaction costs as investors and lenders have to spend more money on due diligence

- it makes it difficult for financial institutions to build human capacity – you can’t build teams around ad hoc processes

- it makes it difficult to aggregate projects – and aggregation is vital in energy efficiency because individual projects are small compared to the need of institutional investors

And what do we need to standardise?

Firstly we need to standardise project development and documentation. This is the province of the Investor Confidence Project and its Investor Ready Energy Efficiency™ system.

Secondly we need to standardise the understanding of risks and value. This is the subject of the EEFIG “Value and Risk Appraisal Framework for Energy Efficiency Finance and Investments” which we have written with COWI for DG ENERGY and will be published in the summer.

Thirdly we need to standardise contracts. There have been several European and UK projects to standardise contracts for Energy Performance Contracting but they are still not widely used and different project developers use their own contracts.

Finally we need to standardise performance measurement and reporting. This is the area of Measurement and Verification (M&V) but it goes beyond M&V and the International Performance Measurement and Verification Protocol (IPMVP). We need to collect and make available information on project and investment performance. Several initiatives are working on this including EEFIG’s De-risking Energy Efficiency Platform (DEEP) developed by COWI for DG ENERGY, the Investor Confidence Project’s Building Button, and the Curve. None of these to date have much in the way of actual performance data – one of the problems with time-series data is that it takes time to collect.

To develop sizable pipelines of projects, which are necessary to attract lower cost institutional capital, two things are needed. Firstly it is necessary to have a proposition that sells – you have to sell something that is compelling to customers and many existing energy efficiency projects and contracts are simply not compelling. Secondly there is no point taking a building-by-building approach – you have to take a portfolio approach whether that portfolio be owned by a single owner like a company or a city, or whether it is a portfolio made up of buildings with different owners.

One aspect of solving this problem is building better business cases based on selling benefits that are strategic to decision makers. Energy efficiency projects have multiple non-energy benefits which are increasingly recognised such as; increased asset value, improved health and well-being, reduced staff turn-over or higher productivity. These benefits are much more strategic, and hence attractive to decision makers, than simple boring old energy savings. With strategic decisions people don’t question the payback so much.

So to sell energy efficiency better, sell the non-energy benefits that are most likely to be strategic for your organisation – and then when you have the attention of the board, add the fact that this project will save x amount of energy and carbon with a payback period of y. Don’t start with energy savings and payback – that is a good way to get a “no” when we all want a “yes”.

We also need to understand and be honest about the risks of energy efficiency. It used to be said that energy efficiency was low risk or even no risk. This simply is not true. Energy efficiency investments have all kinds of risk, especially performance risk which results from the performance gap – the difference between how much energy the project is designed to save and how much it actually saves. The limited amount of data on this is pretty worrying if you are an investor. Then there are other risks like weather risk, change of use risk etc. as well of course the normal credit and counterparty risks.

To better understand risks we need data. In many areas of investing and lending there are decades of data. In energy efficiency there is very little data but new data platforms are emerging such as the De-risking Energy Efficiency Platform (DEEP) developed for EEFIG, Building Button developed by the Investor Confidence Project, and the Curve developed by The Crowd. These data platforms are new and to date have very little actual performance data. Accessing data is hard, the lack of a common language with which to compare projects is a barrier, and of course collecting time series data takes time.

So to really scale up investment into energy efficiency to the levels we need to – we require new structures and organisations that put together the four pieces of the energy efficiency financing jigsaw: finance, building pipelines, standardisation and building capacity. A few examples of these organisations exist but we need more models and more innovation. Good examples include: The Etihad Super ESCO in Dubai, the Carbon & Energy Fund in the UK, and Retrofit Accelerators in the US.

So what of the future? The real future that is just starting to emerge is about moving from paying for stuff to paying for performance. All energy efficiency programmes rely on predictive models (many of which don’t work very well), incentives or mandates with no accountability for savings, and high-level performance measurement based on samples. In Pay for Performance models actual savings would be quantified and paid for on a per unit basis. This would align risks, innovation and project finance and allow energy efficiency to become a truly scalable, and reliable, resource. Pay for Performance models are now being used in California which is putting much store on them working, and are being used in pilots in Germany too.

One interesting thought is to take Pay for Performance beyond just energy efficiency. What do we really want from a building for instance? Clearly we want a pleasant environment but we also want good indoor air quality (IAQ), and the link between IAQ and productivity and well-being is increasingly being proven. Why not pay a building provider on a pay for performance contract for maintaining a set level of IAQ?

To sum up:

- we need to standardise:

- project development and documentation

- understanding of value and risk

- contracts

- performance measurement and reporting

- we need to work on building large pipelines of viable projects which will require both developing new, more compelling business models, and taking a portfolio approach

- we need to consider pay for performance models and using new data and analysis techniques to measure energy efficiency and make it a reliable resource that can truly compete with energy supply options.

Thank you.

Friday 27 January 2017

Fifty years ago today the American space programme had it’s first tragedy – the fire in Apollo 1 that killed Virgil Grissom, Ed White and Roger Chaffee. The fire occurred during a test on the launch pad in preparation for a launch that was scheduled to occur on 21st February 1967. During the hours leading up to the fire there were numerous communications problems which led Gus Grissom the flight commander, who had previously been critical of many problems in the spacecraft and had labeled it a lemon, to say “How are we going to get to the moon if we can’t talk between two or three buildings”. Some time after that a call of “fire” was heard followed by “fire in the cockpit”. The crew did not make it out, despite their own frantic efforts and those of the ground crew battling through toxic smoke. This was mainly down to a complex, three-way, inward opening hatch.

The result of the fire was a 21 month delay in the Apollo programme during which the spacecraft design was greatly improved. As well as the hatch being re-designed to be quick acting and opening outwards, design and manufacturing processes were improved and everything in the vehicle was fire-proofed as far as possible. Procedures were changed, including ground tests being carried out with an atmosphere of air in the capsule instead of the highly flammable pure oxygen used in Apollo 1. In the rush to land on the moon before the end of the 1960s management and workers had become sloppy – the Apollo 1 capsule contained damaged wires and changes had not been well documented. Although the actual ignition source of the fire was never discovered the lowering of standards to make the deadline was a major contributory factor. That is something we should all learn from.

If the fire had not happened Gus Grissom may have been the first man to walk on the moon but it is more likely there would have been a disaster later in the programme, either on the ground or in space, which would probably have stopped the whole project. As it was, three astronauts died horribly but the programme recovered from the tragedy by deeply questioning technologies and procedures and re-doubling its efforts. In October 1968 Apollo 7 tested the revised Command and Service Modules in earth orbit, in December 1968 Apollo 8 orbited the moon, in March 1969 Apollo 9 tested the Lunar Module in earth orbit, in May 1969 Apollo 10 did a complete rehearsal for landing on the moon, and in July 1969 Apollo 11 landed on the moon – a mere two and half years after the Apollo 1 fire. In the modern age where it seems to take forever to do simple things and where we seem to have lost the spirit of exploration, the recovery from the Apollo 7 fire and the subsequent successes of Apollo appears nothing short of miraculous.

“If we die we want people to accept it. We are in a risky business, and we hope that if anything happens to us, it will not delay the program. The conquest of space is worth the risk of life. Our God-given curiosity will force us to go there ourselves because in the final analysis, only man can fully evaluate the moon in terms understandable to other men.”

Gus Grissom

RIP

Virgil I. Grissom, 3rd April 1926 to 27th January 1967

Edward H. White, 14th November 1930 to 27th January 1967

Roger B. Chaffee, 15th February 1935 to 27th January 1967

Wednesday 25 January 2017

This is a version of the presentation I made at the EASME Energy Efficiency Finance Market Place held in Brussels 18th-19th January 2017.

Good morning, today I am going to talk about three important words for the energy efficiency finance market, standardisation, data and risk.

I am going to start off talking about the so-called low-hanging fruit of energy efficiency, one of the most frequently used and mis-used phrases in energy efficiency. As some of you know I have been spending some time in Saudi Arabia in the last year and there are some very significant things happening in energy efficiency down there. This picture shows some low-hanging dates – by the way if you have not had fresh Saudi Arabian dates you need to try them, they are delicious – but anyway, we need to ban the phrase low-hanging fruit.

This next slide shows that investing in energy efficiency is hard work, really hard work. This is the current situation. It is really hard to deploy capital into energy efficiency, deals take a long-time, deals fall apart after long development periods, and many funds have had trouble deploying capital – sometimes even having to return capital to investors because they cannot find viable deals.

Where we need to get to is summed up in the next slide. We need to move towards large-scale, automated processes for investment – just like we have in other financial markets.

I have talked many times before about the need for standardisation in energy efficiency. EEFIG said it was a major problem, Citi Bank have said it is a major problem, and other players like the IEA have agreed. In fact that need for standardisation was the genesis of the Investor Confidence Project. ICP standardises the development and documentation process for energy efficiency projects in buildings. I found another quote about standardisation that I like: “Standards are like DNA. They are the basic building blocks for all technology and economic standards.” All financial markets are based on standards. The industrial revolution was based on standardisation.

So what do we need to standardise? Firstly the development and documentation process for energy efficiency projects. This is what the Investor Confidence Project does. It now exists. It can be used in all countries in Europe and in the USA. Please use it. It works.

Secondly, we need to standardise the understanding of risks and value. This means counting all the sources of value created by energy efficiency projects and being very clear about all the risks. This is the subject of the Energy Efficiency Financial Institutions Group’s “Value and risk appraisal framework for energy efficiency finance and investments” which we are developing for EEFIG and which will be published in the summer.

Next we need to standardise contracts. A lot of work has been undertaken on this in the context of Energy Performance Contracts (EPCs). There are now several European standard contracts and guides for EPC. Of course, as I have said before, we need to develop other contract models that address the problems that EPCs don’t address. Standard contracts exist and can be used.

Finally we need to standardise performance data and reporting. We are now seeing a number of initiatives to do this including EEFIG’s DEEP. I encourage you to use DEEP and provide additional data for DEEP.

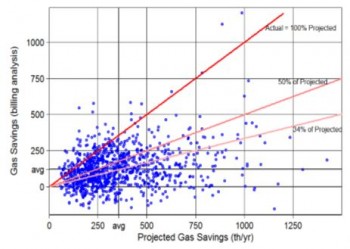

Let’s look at the risks of energy efficiency. When I started in this business many years ago everyone said energy efficiency has no or low risk. Even now people say this. Here is a recent quote I found which will remain anonymous: “The returns are tremendous, and there’s virtually no risk”. This simply is not true. Here is some data from some US projects which show that energy efficiency projects using standard technologies rarely achieve what they are projected to. If you were an investor in these projects, whether you are a householder or a bank, you would not be very happy.

The EEFIG “Value and risk appraisal framework for energy efficiency finance and investments” is a guide to assessing value and risk and aims to provide a common language for project developers and financiers. As well as the document there will be a web based version which will allow anyone to access summary information, more details as well as specific process related resources and references.

Now let’s look at data. Henry Ford launched the first mass-market car the Model T in 1908 and started to change the world. By 1919 car loans were developed and really opened up the market for cars. Therefore we have data on car loan performance for nearly a century. We have data on mortgages for even longer. However, there is still very little data on energy efficiency projects and how they perform. This is due to a number of reasons including:

- Metering and measurement is difficult

- Measurement and Verification relatively new and still not widely used

- Contract forms like EPC mask performance risk

- Performance data considered proprietary.

Data sources are now emerging, or at least the first versions of data sources. The first is DEEP which I mentioned before. There is also Building Button which has been launched by the Investor Confidence Project. The Building Button allows project developers developing projects using the ICP protocols to push a button and start collecting real performance data in a standardised way. There is also The Curve. However, right now even these innovations still have very little real performance data. Collecting and making performance data available is a new concept and of course collecting time series data needs time. An essential part of any future data platform is a common, open source language like BEDES in the USA. Without that we cannot compare like with like, or build data platforms which enable anyone to build apps that mine data for their own specific purposes. The ICP Building Button is based upon BEDES.

So let’s pull together standardisation, data and risk.

First of all different sources of finance take different risks. There is equity which takes equity risks and debt which takes debt risks, and all the shades in-between. PACE financing in the US for example, is based on property tax which is senior to mortgages and is therefore very low risk. People have to pay their PACE repayment on their property taxes or the local government takes over their house. Energy Performance Contracts transfer performance risk to an ESCO but what is the price of transferring that risk? Often too high I think.

We need to move towards a world in which the risks are sliced up and transferred to the parties most willing and able to take those risks. The role of insurance is important here and we are seeing some insurance companies step up to take performance risk, a trend that will expand. Emerging business models like Managed Energy Service Agreements or Metered Energy Efficiency Transactions address risk in different ways. Finally of course, the ultimate source of low-cost capital, the debt capital markets, requires a lot of standardisation and data.

So to sum up, right now we are still in a world in which investing in energy efficiency is a niche activity and is really, really hard work. To move to a world in which it is mainstream and easy we need to make it like every other financial market. To move to that future we need standardisation, acknowledgement and understanding of risks, and data ….. data, data and data.

Thank you.

Thanks to EASME for organising the Energy Efficiency Finance Market Place which was very successful with over 400 attendees which demonstrates the growth of interest in the market.

Dr Steven Fawkes

Welcome to my blog on energy efficiency and energy efficiency financing. The first question people ask is why my blog is called 'only eleven percent' - the answer is here. I look forward to engaging with you!

Tag cloud

Black & Veatch Building technologies Caludie Haignere China Climate co-benefits David Cameron E.On EDF EDF Pulse awards Emissions Energy Energy Bill Energy Efficiency Energy Efficiency Mission energy security Environment Europe FERC Finance Fusion Government Henri Proglio innovation Innovation Gateway investment in energy Investor Confidence Project Investors Jevons paradox M&V Management net zero new technology NorthWestern Energy Stakeholders Nuclear Prime Minister RBS renewables Research survey Technology uk energy policy US USA Wind farmsMy latest entries

- ‘This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning’

- You ain’t seen nothing yet

- Are energy engineers fighting the last war?

- Book review: ‘Stellar’ by James Arbib and Tony Seba

- Oh no – not the barriers again

- Don’t assume ignorance, sloth, bias or stupidity

- Collaborations start with conversations