Tuesday 6 January 2015

Henry Chesbrough, one of the great innovation thinkers who coined the term open innovation, said:

- a startup is a temporary organization in search of a repeatable, scalable business model.

- a corporation is a permanent organization designed to execute a repeatable, scalable business model.

which neatly summarizes the huge differences between the two types of organizations.

I was reminded of this quote during the 2 Degrees Live Energy Performance Summit on 12th December when I was part of a panel talking about the RBS Innovation Gateway. The RBS Innovation Gateway seeks to identify innovative companies (or concepts) that offer ways of reducing energy, water or waste in buildings. Unlike other corporate sponsored innovation programmes the Gateway actually offers the possibility of trialing the innovations within the extensive RBS estate.

Thinking about the quote from Chesbrough, and about RBS, which is a bank which has gone through massive changes in the last decade, the ambition of the RBS Innovation Gateway is particularly impressive. Here we have a big corporate – and a bank at that – deliberately putting itself out there to interact with innovative startups and SMEs in a programme with a business and social purpose. Well done to the RBS team for taking such a risk. The Gateway has attracted the innovative companies, now the next steps (currently underway) are to trial the innovations in the RBS estate and measure the results – both in terms of individual projects but also at the programme level. From here the programme could go in several directions including being opened up to other corporates (which is already happening), and maybe into some kind of fund structure.

At the 2 Degrees Live event I said “you have to be crazy to innovate” (speaking as someone who has innovated and loves innovation!) and the comment was tweeted. Someone from the US responded “you have to be crazy NOT to innovate”. As I said in my response to that tweet, that is one of the paradoxes of innovation. We need to innovate, we have the desire to change things hardwired into our genes and yet innovation is really difficult and at some levels we dislike change.

At the event I also used a few of my favourite quotes related to innovation which I try to bear in mind when looking at innovative companies. Here are some more of them.

“Electric lighting is a completely idiotic idea” Chief Engineer, Post Office, 1881

“The substitution of oil for coal is impossible, because oil does not exist in this world in sufficient quantities” Lord Selbourne, First Lord of the Admiralty, 1904

“We over-estimate what we can achieve in the short-term and under-estimate what we can achieve in the long-term” Arthur C. Clarke

“Success doesn’t necessarily come from breakthrough innovation but from flawless execution. A great strategy alone won’t win a game or a battle; the win comes from basic blocking and tackling.” Naveen Jain

“..as we know, there are known knowns; there are things we know that know that we know. There are known unknowns; that is to say, there are things that we now know we don’t know. But there are also unknown unknowns – there are things that we do not know we don’t know.” Donald Rumsfield, US Secretary of Defense

“the famous inventor considers his new storage battery the most valuable of all his inventions, and believes it will revolutionize the whole system of transportation”. Harper’s Magazine, 1901, writing about Thomas Edison’s battery factory – the “giga factory” of the age.

“Innovation is the specific instrument of entrepreneurship. The act that endows resources with a new capacity to create wealth.” Peter F. Drucker

“If you want something new, you have to stop doing something old” Peter F. Drucker

“Innovation is hard. It really is. Because most people don’t get it. Remember, the automobile, the airplane, the telephone, these were all considered toys at their introduction because they had no constituency. They were too new.” Nolan Bushnell

“Remember the two benefits of failure. First, if you do fail, you learn what doesn’t work; and second, the failure gives you the opportunity to try a new approach.” Roger Von Oech

“It isn’t all over; everything has not been invented; the human adventure is just beginning.” Gene Roddenberry

“You have to take your own bold approach, and if you do you will be rewarded with success. Or calamitous failure. That can happen too.” Steven Moffatt

“To be successful, innovation is not just about value creation, but value capture.” Jay Samit

“Innovators are inevitably controversial.” Eva Le Galiienne

Have a healthy and successful 2015.

Wednesday 17 December 2014

On the 10th December I helped launch the Local Authority Energy Index at a reception in the House of Commons. The Index is a new initiative developed by EnergyPro Ltd (my company) in partnership with Knauf Insulation. It is a pilot project with the purpose of providing a measure of performance of authorities on the energy efficiency agenda and to provide examples of best practice that others can learn from. The Index can be found here: (www.laenergyindex.co.uk)

The initial Local Authority Energy Index covers 25 local authorities in England covering a range of geographies, authority type and socio-economic factors. It uses a range of quantitative and qualitative indicators and draws upon telephone interviews and consulting publicly available data. It looks at four areas that we think are important:

- energy management of the authority’s own property portfolio

- energy efficiency in the community (mainly non-domestic)

- energy efficiency in housing

- energy infrastructure.

We gave energy management of the authority’s own portfolio a high weighting as we consider it to be the foundation stone for implementing a broader energy agenda. It is important that authorities “walk the walk”, understand the processes of improving energy efficiency, and are convinced by the results. Important factors in this category included; having explicit targets and public reporting of progress, existence of Monitoring and Targeting systems, and the adoption of ISO5001.

We identified a number of concerns in this area including the fact that in some authorities the energy management team have been cut back, at a time when efforts should be increased. Also many energy managers, as in other sectors, are having to spend too much time completing data requests e.g. for CRC and not enough time developing investable projects. Also in some cases the carbon agenda had over-ridden energy management fundamentals and although carbon reduction targets existed energy reduction targets did not.

The energy efficiency in the community category covered factors such as whether the authority was proactively working to help building owners (and/or industry) to improve energy efficiency. This could be through programmes like Cambridge Retrofit or supporting grass roots initiatives.

Energy in housing remains a major issue, particularly given the persisting problem of fuel poverty with all of its attendant costs which appear in the benefit system and the health system. In this category we tried to measure how effective authorities had been in mobilizing funds such as those that were available through CERT and CESP. We did not include ECO as the programmes are still in the early stages and there was little data available on results. In future we will include ECO programmes.

The changes in the energy sector, which is moving towards decentralization and greater flexibility, coupled with the high levels of distrust of big energy companies, mean that there are opportunities for local authorities to become more directly involved in the energy system, even build their own infrastructure. This can take different forms including developing District Heating systems, Combined Heat and Power, local renewables and launching their own energy supply and energy service companies. The latter is a rapidly emerging trend with authorities such as Glasgow, Nottingham, Bristol and Peterborough all moving in that direction which promises to be a major disrupter of the energy market.

Finally in the index we also looked at overall indicators such as energy per capita and energy per Gross Value Added. Although these are affected by many factors completely outside the control of local authorities (including economic mix, type of building stock etc) in time these should be the variables we are all trying to influence.

Over the last few years the large potential for mitigating local and global energy problems through improving energy efficiency has been increasingly recognized but, despite being the cheapest, cleanest and fastest way of delivering energy services, the potential for improved energy efficiency remains under-utilized for a number of structural and historical reasons – some of which can be addressed by local authorities as they have many touch points with energy and can affect levels of energy efficiency in many ways. We believe that those authorities which proactively address this matter in a holistic way will reap great benefits through improved health and welfare, improved finances and local economic development, which will far outweigh the value of energy cost savings alone. Some local authorities in the UK have shown leadership in energy efficiency, either across the whole field or in specific areas, and we hope that the Local Authority Energy Index will help spread best practice and accelerate efforts to improve energy efficiency.

We welcome input and suggestions for improving the index and look forward to developing it in future – both to cover more authorities and to provide improved measures of performance.

Thanks to Knauf Insulation, Michael Floyd and the rest of the Energy Index team and our supporters including Dave Watts MP, Alan Whitehead MP, Dave Sowden of Sustainable Energy Association, Richard Griffiths of UKGBC and many others.

Tuesday 9 December 2014

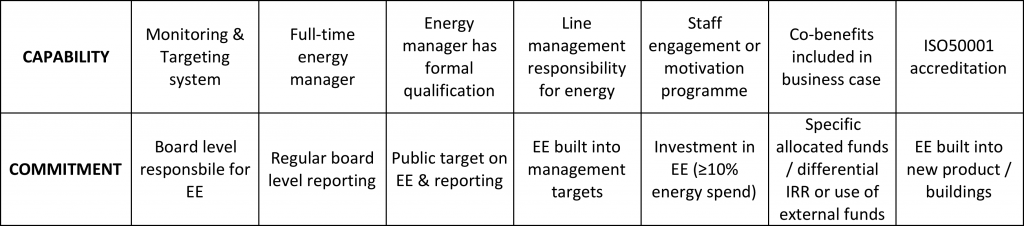

I have written before about how – if we are to really scale up the level of energy efficiency activity – we need to increase capacity in the demand side of energy efficiency, the supply side of energy efficiency and the finance of energy efficiency. All three aspects need to be worked on in a systematic way. Part of building capacity in the demand side i.e. amongst energy users, is developing new tools for developing and running more effective energy management programmes. This post is about a new tool inspired by the Innovation Matrix developed by Tim Kastelle1.

Although energy efficiency had gone through periods where it received attention several times before – notably in the post-war period when fuel was short and the UK was in dire financial straits – energy management started to develop as a more professional discipline in the late 1970s after the 1973 and 1979 oil crises. Several management tools were developed, starting with what should be the foundation of any energy management programme, Monitoring and Targeting (M&T). M&T consists of agreeing a base line consumption, setting a target for consumption and recording progress against that target. Another tool developed in the 1990s, (originally by the Building Research Establishment), was the energy management matrix which is a way of measuring where organizations are in the different dimensions of energy management including; policy, organization, training, communication and investment. Despite being adopted (and adapted) in the UK, the US and Australia it never really caught on despite some having potential as a useful tool for agents of change to analyze where an organization was in energy management and what actions were required to improve performance. Fundamentally it didn’t go to the heart of the problem – effective action in energy management – like in innovation or just about anything else – needs two things; commitment and capability.

Having seen Tim Kastelle’s innovation matrix, which maps organizations according to their innovation commitment and capability, I thought about how to measure these two characteristics for energy management within organizations. Although energy management isn’t often thought of as innovation it really is a form of innovation or technical change – even if most of the innovation is incremental and utilises existing technology in a specific application or building where it has not been applied before rather than breakthrough, “first of its kind” type innovation. The two factors, commitment and capability, really are the two critical factors for effective change in area – you can have commitment without capability and you can have (and this is often the case in many organizations) real energy management capability at the technical/energy manager level without real top management commitment. Many energy managers would recognise that situation in their own organization.

Commitment by top management to energy management is vital to success just like it is to any activity within an organization. Without high-level commitment things don’t really happen – once that commitment is there they do happen – it is a fact of life.

So I started thinking about what characteristics demonstrate commitment and capability in energy management.

Commitment to energy management can be evidenced by the following:

- Having a board member responsible for energy management

- Regular reporting of energy management performance at board level.

- Reporting can be on different frequencies depending on the organization but it needs to happen and everyone in the organization needs to know that it happens.

- A public target for energy efficiency improvement, typically expressed in energy intensity but increasingly in absolute energy terms. This would often be included in a sustainability report.

- Energy efficiency built into management targets and bonus schemes. Unless management at all levels – and indeed even the shop floor employees – have energy efficiency targets the level of effectiveness of any programme will be hampered. Ideally responsibility for energy efficiency has to be passed to the lowest level of person who can have some influence over energy use – which is often everyone.

- At the end of the day commitment is evidenced by investment. It is hard to be certain what the right level of investment is, and this will vary by industry and organization, but back in the 1980s many examples from the public sector showed that it was possible to profitably invest an amount equal to ten per cent of energy spend into energy efficiency every year for many years.

- Real commitment to investment will be evidenced by use of a specific allocated amount for energy efficiency, possibly differential IRRs to other investments – reflecting the truly strategic nature of energy efficiency which is not always recognized, or the use of external third party funds through some kind of shared savings deal or bond issue such as that recently done by Sainsburys.

- Incorporating best practice, or beyond best practice, levels of energy efficiency into new product development or new buildings shows a high level of commitment. These major decisions always have to have high level support and often opportunities are missed in new building or product projects unless there is high level support, and perhaps even positive pressure, to utilize them.

Energy management capability is demonstrated by:

- Having a Monitoring and Targeting (M&T) system that demonstrates energy use, targets energy savings and records progress against targets for each building, factory or facility. M&T was developed in the 1980s and proven to be highly successful in all situations and sectors. Without M&T there can be no effective energy management programme.

- Having a full-time energy manager. Clearly this is related to the size of the organization and its energy spend. In smaller organizations this requirement could be relaxed but in those cases there should be access to the equivalent of an energy manager, possibly through retained consultants or an energy management bureau.

- The energy manager having a formal qualification in energy management. In the UK this qualification would be through the Energy Institute or in the USA it would be Certified Energy Manager through the Association of Energy Engineers. Energy management is now codified and practitioner should have appropriate qualifications.

- Responsibility for energy usage has been passed onto line managers. This is based on the principle that although specialized energy managers can run M&T systems and identify, develop and implement energy efficiency projects they cannot control energy use day by day, minute by minute, in every building or factory within their organization. Responsibility for energy management has to be passed onto those people who can control energy use and that is building, factory, line, cost-centre managers or even shop floor operatives. Many organizations still fail to do this – fostering the belief that energy management is something done by an energy manager or engineering support function.

- Staff engagement programmes have been found to be effective in improving energy efficiency. The existence of a staff engagement programme is evidence of further capability as they usually involve training and hence build capacity amongst all staff members. It is important, however, to remember that “awareness is not everything” – most research in the field shows that simply having more factual information about a situation influence peoples’ attitudes or action2.

- Recent work by the IEA3 and others have documented the multiple benefits of improving energy efficiency. These are many and various but include, even at the level of the host organization, factors such as improved productivity, improved employee engagement, reduced sickness time and reduced need to invest in energy supply infrastructure. Work by Cooremans4 has highlighted that energy efficiency can be a strategic investment –but is all too often simply viewed as a cost saving investment which inevitably receives less attention than strategic investments. It is important that the strategic nature of energy efficiency investments, and as far as possible, all the co-benefits – are included in energy efficiency business cases. Forward thinking organizations such as Lego do this – even when quantifying benefits is difficult they recognize them and make reasonable, defensible estimates. Inclusion of co-benefits in business cases for energy efficiency is a measure of advanced energy management capability.

- ISO50001, the energy management standard, was introduced in 2011. Like all standards it has to be used with care. As someone said about the quality standard ISO9001 you could have ISO9001 for making concrete lifejackets as long as you made them to a consistent standard. However ISO50001 means that for the first time the management of energy is subject to a standardized process. It is based upon the PDCA approach – Plan, Do, Check, Act – and sets out processes for energy management systems that enable an organization to continually improve energy performance. Achieving ISO50001 demonstrates a high level of energy management capability (as well as commitment).

A truly effective energy management programme, one in which the organization consistently improves energy productivity by a combination of good control of day-to-day energy use, employee engagement, and continuous creation, development and implementation of viable energy efficiency projects, is likely to have high levels of both commitment and capability. Effectiveness will ultimately be shown by continuous improvement in energy productivity.

Some of the best management tools use 7 factors; “The McKinsey 7-S Model” by Bob Waterman, Tom Peters and Julien Phillips5, “Seven Deadly Diseases” by W. Edwards Deming6 and of course “The Seven Habits of Highly Effective People” by Stephen R. Covey but in this case a 7 x 7 matrix presentation didn’t really work so I came up with a 2 x 7 matrix. The final version of the matrix is shown below.

This new energy management matrix can be used by senior management, other agents of change, and analysts to determine where an organization is in both the important dimensions of energy management, capability and commitment, and where it can be improved. The ideal situation is to have a high score, ideally 7, on both scales. My hypothesis (based on years of observation and involvement in many energy management programmes) is that an organization’s overall ability to manage energy, its energy management effectiveness – as evidenced by improvement in energy efficiency over time – will be higher the higher the level of commitment and capability. Academic – or practical – research could test the hypothesis. It would be good to get feedback and hear of any results of applying the matrix.

1. Tim Kastelle. The Innovation Matrix Reloaded. http://timkastelle.org/blog/2011/06/the-innovation-matrix-revised/

2. Ham, S.H. Can Communication Really Make a Difference? Answers to Four Questions from Cognitive and Behavioural Pyschology.

http://www.interpretiveguides.org/dbfiles/13.pdf

3. IEA, 2014. Capturing the Multiple Benefits of Energy Efficiency

http://www.iea.org/W/bookshop/475-Capturing_the_Multiple_Benefits_of_Energy_Efficiency

4. Cooremans, C. Strategic fit of energy efficiency. (Strategic and cultural dimensions of energy-efficiency investments). ECEEE 2007 Summer Study.

http://www.eceee.org/library/conference_proceedings/eceee_Summer_Studies/2007/Panel_1/1.177/paper

5. Waterman, R.H., Peters, T.J. & Phillips, J.R. Structure is not organization.

http://tompeters.com/docs/Structure_Is_Not_Organization.pdf

6. Deming, W.E. The seven deadly diseases.

https://www.deming.org/theman/theories/deadlydiseases

Wednesday 29 October 2014

One of the essential pieces of the jigsaw that we have to build to greatly accelerate investment into energy efficiency, particularly third party investment, is the standardization of project development and documentation. This is the area addressed by the Investor Confidence Project (www.eeperformance.org), an open-source initiative created by the Environmental Defense Fund in the USA which has created Protocols for developing projects in different categories of building and has considerable traction with banks, investors, the energy efficiency industry, and city and state programmes. As well as Protocols the Project has launched a Quality Assurance system called “Investor Ready Energy Efficiency SM” and an open data initiative. The Investor Confidence Project approach reduces due diligence time and cost, enables aggregation of projects and ultimately will facilitate a secondary market in energy efficiency finance such as the issuance of bonds. It also allow banks and financial institutions to build teams around standardized processes – no bank or investor can build a team around an ad hoc approach where every project is different which is the current state of affairs in energy efficiency. In time it will allow the collection of standardized performance data which can be used by investors. All of these things are necessary to facilitate a thriving and much enlarged energy efficiency financing market as no financial product – or at least no financial product that is used at scale – can exist without commonly agreed standards. Think about the standardization behind mass-market financial products such as mortgages, car loans, credit cards etc, and the bonds being used to re-finance them which draw on the debt capital markets. Unless we can get to that stage with energy efficiency finance we can’t finance the huge amount of investment that we need to. The Building Performance Institute Europe estimates that between €500 billion and €1,000 billion needs to be invested in energy efficient renovation of Europe’s buildings by 2050. This level of finance can only come from the private sector.

The Investor Confidence Project Europe concept has had some great support, the EU and UNEP Energy Efficiency Finance Investors Group (EEFIG) in its report, “Energy Efficiency – the first fuel for the EU Economy,” specifically highlighted the Investor Confidence Project and said that “[Europe needs the] launch of an EU-wide initiative to develop a common set of procedures and standards for energy efficiency and buildings refurbishment underwriting for both debt and equity investments”. The International Energy Agency in its “Energy Efficiency Market Report 2014”, issued on 8th October said: “[Investor Confidence Project] will facilitate a global market for financings by institutional investors that look to rely on standardized products rather than project-specific structuring and due diligence.”

After many months of effort and work with the Environmental Defense Fund we have obtained funding and will be launching Investor Confidence Project Europe in Brussels on 5th November before the Renovate Europe event (http://www.renovate-europe.eu/reday2014/reday2014-draft-programme), and presenting at the BPIE Investor Day on 6th November (http://bpie.eu/investors_day.html). Building on the success of Investor Confidence Project in the US, the Investor Confidence Project Europe will bring together investors, banks, property owners and the energy efficiency industry to develop protocols to standardize the development and documentation of energy efficiency projects.

It is important to understand what the Investor Confidence Project is not. It is not developing new technical standards – plenty of these exist, rather it is about using the available standards in a common way through the entire process of developing and documenting energy efficiency projects. It is not about limiting engineering creativity. It is not about standardizing contracts – there have been previous attempts at this in Europe particularly around Energy Performance Contracts. As I have said several times before we need innovation in contract form and the Investor Confidence Project approach can be used with any contract form, or any source of funds – including internal corporate funds (CFOs are investors too). Finally the Investor Confidence Project Europe is not about enforcing a US model – the process of developing a project everywhere goes through the same stages but uses different engineering standards. What will be common between the US and Europe is an approach, not specific standards or protocols. This is essential because the world of finance is international and many of the large institutional investors who want to invest in energy efficiency, but are currently constrained from doing so, operate on both sides of the Atlantic and indeed around the world.

We have built a powerful pan-European coalition of banks, development banks, investors, property owners, ESCOs, energy efficiency companies, government agencies, NGOs and others who are supporting the Investor Confidence Project Europe. We have a Steering Group (still a few spaces left if anyone wants to volunteer) and are recruiting a Technical Panel to contribute to and oversee the drafting of the protocols to ensure they can be readily used. We have a Project Director, Panama Bartholomy, (panama.bartholomy@eeperformance.org) who has a wealth of energy efficiency experience gained in Californian government but now lives in the Netherlands. We are looking forward to kicking off the project. We are looking to further engage with investors, banks, cities and regions looking to accelerate investment into energy efficiency.

To support this important initiative, please sign up as an Investor Confidence Project Ally at http://www.eeperformance.org/europe-allies.html, volunteer for the Steering Group, a national Steering Group or the Technical Panel.

Please direct any questions or suggestions to myself or Panama. We look forward to working with everyone involved and really helping to accelerate investment into energy efficiency.

Wednesday 22 October 2014

It may be surprising to some but Saudi Arabia has a vigorous programme to promote energy efficiency. The rationale for this is an analysis that shows the rapidly increasing Saudi population, and rising wealth coupled with very low energy prices means that Saudi electricity demand is growing at 7% per annum and domestic use of oil is growing at 5% per annum. In 2012 domestic oil use reached 35% of production and in 2011 Chatham House estimated that by c.2035 domestic oil consumption could equal production1. Clearly if that scenario ever happens the Saudi economy, and no doubt political structure, would be under severe pressure and there would be a major impact on the global oil market.

With this in mind, in 2003 Saudi Arabia launched a national effort (the National Energy Efficiency Program, NEEP) to enhance demand side efficiency. Between 2007 and 2010 there was an initiative by the Ministry of Petroleum to transfer the NEEP to a permanent entity and in October 2010 the Saudi Energy Efficiency Center (SEEC) was formed. The mission of SEEC is to “reduce energy consumption and improve energy efficiency to achieve the lowest possible energy intensity”.

It’s key tasks are to:

- develop an EE plan covering policies, regulations and initiatives

- monitor the implementation of the plan

- promote EE awareness and support building capacity

- promote the EE industry.

In 2012, SEEC in conjunction with ministries, regulatory authorities and major companies launched the Saudi Energy Efficiency Program (SEEP). SEEP is purely focused on demand side management and its remit does not include the issue of price reforms. The subject of energy prices, which are heavily subsidized to consumers, is highly sensitive in the Middle East. In 2012 there was civil unrest when the Jordanian government changed the subsidy regime on fuel and there is no doubt that all Middle Eastern governments are very conscious of the social impacts of changing energy subsidies – especially at this time of instability in the region.

The SEEP is focused on three sectors; industry, buildings and transport.

Industry represents 42% of total energy use with 80% of the energy going into the petrochemical, cement and steel industries. Feedstock is not part of SEEP as it is handled by the Ministry of Petroleum and Mineral Resources. In the cement industry over 600 cement plants were benchmarked with the World Business Council for Sustainable Development (WBCSD), all plants were visited to share the methodology, targets were set for existing plants, a defined maximum energy intensity was set for the design of new plants, and the new roles and responsibilities were developed. In addition SEEC is looking to enhance its mandate to include the collection of data, the setting of targets and their enforcement. Another major energy user in Saudi Arabia of course is desalination of water and there are programmes to improve the efficiency of desalination.

Buildings account for 23% of Saudi’s energy use with not surprisingly 70% being used for cooling. The aim is to catch up with the rest of the world in terms of standards and codes. In Buildings the key energy efficiency initiatives have included:

- updating the efficiency standards for small capacity air conditioners to ASHRAE standards

- developing an efficiency standard for large air conditioners

- updating thermal insulation product standards

- finalizing efficiency standards for residential lighting products

- developing efficiency standards for commercial and street lighting products

- updating efficiency standards for refrigerators and washing machines

- updating the Saudi Building Code energy conservation section (SBC 601) to ASHRAE standards

- developing a process to ensure proper enforcement of SBC601.

Transport accounts for 23% of total energy use. There are 0.7m Light Duty Vehicles (LDVs) entering the market every year and the stock of LDVs is forecast to reach 20 million by 2030. Incoming LDVs have low average fuel economy given the nature of the fleet mix. In transport SEEC, working with its partners, has developed fuel economy standards in line with international benchmarks. Specific measures include:

- developing a Saudi specific fuel economy standard for LDVS (to catch up with US CAFE standards over time)

- adopting a fuel economy label design similar to EU’s to be enforced on LDVs from model year 2015

- developed a tyre rolling resistance and wet grip standard for LDVs

- identifying key initiatives for Heavy Duty Vehicles (HDVs) (anti-idling regulations, aerodynamic additives, light weighting and mandatory retirement of old HDVs.

Energy intensity in Saudi Arabia intensity has grown significantly over the last 25 years, particularly since 1985, reflecting the growth of the economy, its level of economic development and reliance on heavy industry. Energy intensity was twice the world average in 2010 and energy use is still growing faster then the economy. The overall objective of SEEC is to reduce the electricity intensity by 30% between 2005 and 2030 and half the peak demand growth rate by 2015 compared to the period 2000-2005.

As well as energy efficiency Saudi Arabia is of course also pursuing renewable energy and nuclear power. It has a target of attracting investment of $109 billion in renewables and building 54 GW of renewables by 2032 (producing half of all electricity demand), as well as 18 GW of nuclear. So far, however, the largest ground mounted PV plant, at the King Abdullah Petroleum Studies Center (KAPSARC) is only 5 MW. Keeping PV panels clean is a major issue in the harsh, dusty climate.

Clearly there is a long way to go but it is encouraging that Saudi Arabia is working to improve energy efficiency. As in many other issues Saudi Arabia faces particular constraints that are rooted in unique social and historical factors – balancing these factors and modernization is a massive challenge. Given the importance of Saudi in the oil market globally and the region generally we should support the national energy efficiency programme’s success. The fact that there is a vigorous Saudi’s programme just adds to the view that the potential resource of energy efficiency is now widely recognized everywhere, but in Saudi as everywhere else we now need to improve the utilization of that resource and work to make investing in efficiency as mainstream as investing in oil, gas and renewables.

Dr Steven Fawkes

Welcome to my blog on energy efficiency and energy efficiency financing. The first question people ask is why my blog is called 'only eleven percent' - the answer is here. I look forward to engaging with you!

Email notifications

Receive an email every time something new is posted on the blog

Tag cloud

Black & Veatch Building technologies Caludie Haignere China Climate co-benefits David Cameron E.On EDF EDF Pulse awards Emissions Energy Energy Bill Energy Efficiency Energy Efficiency Mission energy security Environment Europe FERC Finance Fusion Government Henri Proglio innovation Innovation Gateway investment in energy Investor Confidence Project Investors Jevons paradox M&V Management net zero new technology NorthWestern Energy Stakeholders Nuclear Prime Minister RBS renewables Research survey Technology uk energy policy US USA Wind farmsMy latest entries